Weekly Perl: A Commercial Real Estate News Recap

If the Fed Is Cutting Interest Rates, Why Are 10-Year Treasury Yields Rising? How Does It Affect You?

Official interest rates are declining, but not the rates that could matter the most to everyday Americans.

Treasury yields ticked up to a three-month high on Wednesday morning despite near certainty on Wall Street that the Federal Reserve was hours away from cutting interest rates. The 10-year Treasury yield, which influences interest rates on a variety of consumer loans including mortgages, rose Wednesday morning to 4.21%, its highest level since early September. Meanwhile, traders put the probability of a quarter-percentage-point cut today by the Fed at about 90%...

Black Friday retail sales up 4.1%, according to Mastercard SpendingPulse

Chilly temperatures and seasonal deals encouraged spending on new fashions as apparel turned in a robust Black Friday performance.

Apparel and jewelry were the top gifting sectors on Black Friday, with apparel up 5.7% year over year (online up 6.1%, in-store up 5.4%) and jewelry up 2.75% year over year, according to preliminary insights from Mastercard SpendingPulse, which measures in-store and online retail sales and represents all payment types. It is not adjusted for inflation...

Arby’s Second-Largest Franchisee Expands to 344 Stores after Major Inspire Brands Purchase

Add AES Restaurant Group to the list of franchisees making major store acquisitions this year.

The Zionsville, Ohio–operator announced the purchase of 115 Arby’s restaurants across nine states, which expanded its total portfolio to 344 units in 20 states. AES is the second-largest Arby’s franchisee in the world.

The group bought the locations from parent company Inspire Brands. The locations come with over 2,000 employees and 18 area supervisors...

Kroger to increase new store builds in 2026; Q3 e-commerce sales jump 17%

The Kroger Co. reported strong sales for its third quarter as its digital business surged and said it expects to appoint a new CEO during the first quarter of 2026.

On the company’s earnings call, chairman and interim CEO Ron Sargent said the company plans to accelerate capital investment in new stores beyond 2025 to strengthen its competitive position, expand into high-potential geographies and support long-term growth...

Netflix could own some of the nation’s top entertainment real estate following Warner Bros. deal

An agreement by Netflix, the world’s largest streaming service, to buy television and movie giant Warner Bros. Entertainment in a $72 billion deal would involve a large swath of entertainment real estate across the globe.

The Los Gatos, California-based online entertainment service's deal to acquire Warner Bros.’ film and television studios, HBO and HBO Max for cash and stock is slated to close after Warner Bros. Discovery completes a planned separation of its global networks division in late 2026...

Angry Chickz plans Texas, New Mexico expansion — here's where

A California-based Nashville hot chicken franchise is expanding its footprint into two Southwestern states.

Angry Chickz will open 25 new locations in Texas and New Mexico over the next five years. The expansion will span 11 new markets, including the Dallas–Fort Worth and Austin areas, western Texas, and Albuquerque (see full list at end of article). The first restaurant is slated to open in 2026...

Family Dollar drops 110 stores from network in November

Family Dollar was aggressive with its store closings in November, shuttering 110 locations, according to the latest data from ScrapeHero. Meanwhile, Walmart actually closed a location in Federal Way, Wash. On the positive side, Dollar Tree opened 17 stores, including three in Virginia...

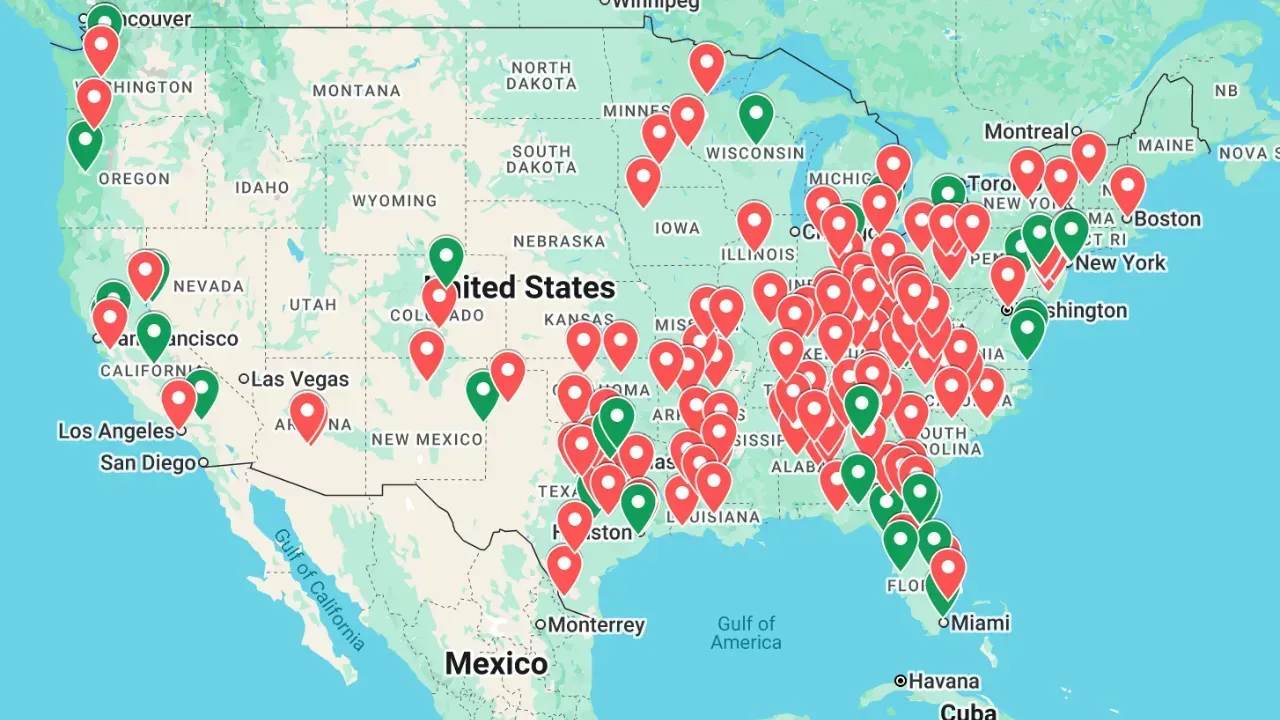

Advance Auto Parts puts 83 properties on the market

Advance Auto Parts — which operates more than 4,000 centers in the United States, Canada, Puerto Rico, and the U.S. Virgin Islands — is parting with 83 of them.

The company has retained Gordon Brothers to dispose of the owned and leased sites, which span 38 states. The available spaces range in size from 4,000 to 16,000 square feet.

“We are excited to work with such a great partner and assist the exceptional in-house real estate team at Advance Auto Parts as they right size their portfolio for the future,” said Michael Burden, co-head of North America Real Estate at Gordon Brothers...