Weekly Perl: A Commercial Real Estate News Recap

Japan's Konbini convenience stores coming to the U.S.

In Japan, Konbini convenience stores have become part of the country's infrastructure, offering fresh meals delivered several times a day, tickets to concerts and museums, and even services like bill payments. Now the model is coming to the U.S., where critics question whether it will resonate with American customers...

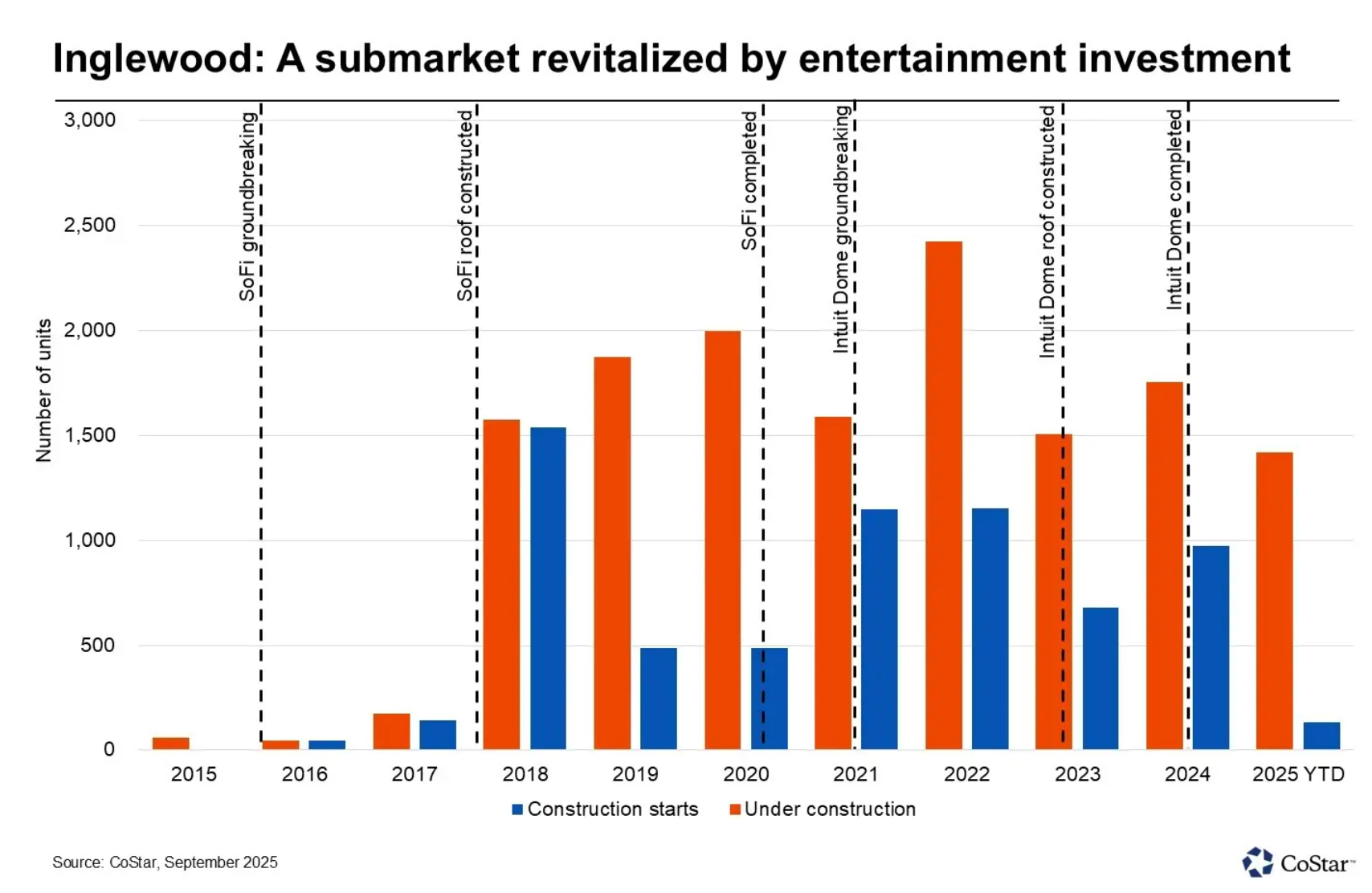

Inglewood’s multibillion-dollar makeovers: How major redevelopments transformed the multifamily market

During the early 2010s, the city of Inglewood, California, was experiencing significant financial difficulties. Following the Great Recession of 2008, the unemployment rate reached 17%, with 22% of residents living below the poverty line, per the 2010 U.S. census. Average market asking rents were 17% lower than in the rest of the Los Angeles metro area...

Starbucks abandons some high-profile urban locations around the country

Of the hundreds of locations that Starbucks is closing, many are in high-profile and busy urban areas — prime retail real estate — as a post-pandemic drop in downtown foot traffic, competition from upstart rivals and a growing preference for drive-thru service take their toll on the coffee giant...

Dunkin', like other chains in the QSR Drive-Thru Report, is balancing technology and hospitality as the landscape shifts.

Let’s start with a debate on consumer behavior: Are fewer restaurant goers visiting the drive-thru?

From January 2024 through June 2025, there have been consistent gains in dine-in, delivery, and takeout trends—the latter spiked 25.8 percent alone in October 2024, according to Revenue Management Solutions. Yet drive-thru remained in negative territory month after month, falling as deep as 13.3 percent last summer and still hovering between minus 5 and 8 percent in 2025...

Spirit Christmas unwraps US holiday store expansion

Spirit Halloween, best known for its ubiquitous spooky holiday stores, is bringing back its other brand, the one that’s more steeped in elves and reindeer than witches and ghosts.

After a trial run last year, Spirit Halloween plans to once again open Spirit Christmas pop-ups. But this go-around, it intends to have 30 of the seasonal retail locations “across the Northeast and Great Lakes regions, nearly quadrupling its footprint from last year,” the Egg Harbor Township, New Jersey-based company said...

Meijer’s next stop will be Western Pennsylvania

Meijer is expanding into Western Pennsylvania, the grocer confirmed to Supermarket News on Wednesday.

The Grand Rapids, Mich.-based retailer has begun purchasing land in a region currently served by Giant Eagle. Earlier this year, Wegmans also announced plans to enter Western Pennsylvania with a 115,000-square-foot location expected to open in 2027...

Billionaire's Los Angeles area purchase expected to clear way for surf park

A high-profile parcel once slated for an office and retail development to complement the new headquarters for the Los Angeles Chargers professional football team in El Segundo is now poised to make waves as a different property use.

A company tied to billionaire Vinny Smith’s Toba Capital has spent $54 million for a 9-acre slice of the former Raytheon Technologies Campus at 100 Nash in the city adjacent to Los Angeles, according to CoStar data...

Costco Q4 tops Street, to open 35 new warehouses; holiday mix to look ‘different’

Costco Wholesale Corp. reported another solid quarter amid strong e-commerce sales, and as it continues to attract new members.

The retailer’s membership fee income rose 14% to $1.72 billion during the quarter. In September 2024, Costco raised its annual membership fee — the first hike since 2017 — by $5. On the earnings call, CFO Gary Millerchip said that the increase accounted for a little less than half of its membership fee income growth in the quarter...