Weekly Perl: A Commercial Real Estate News Recap

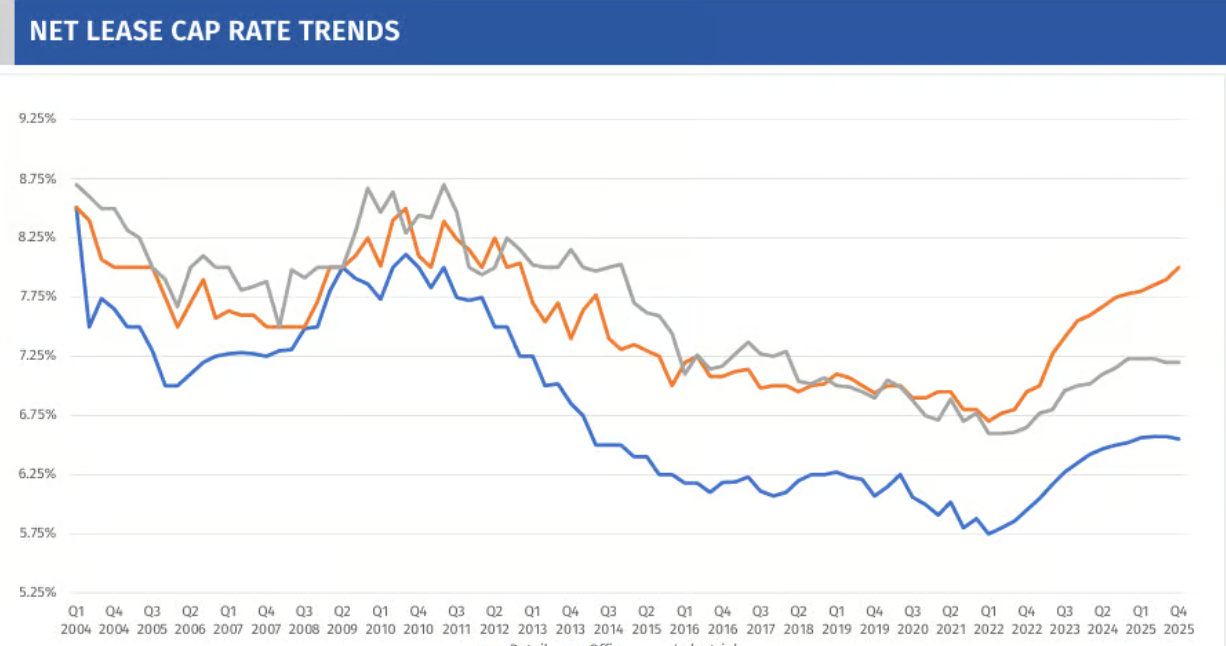

Net Lease Cap Rates Stabilize as Market Focus Shifts to Risk Over Rates

The net lease market barely budged in Q4, but beneath the surface, investors are repricing around risk—not the Fed.

Cap rates hold steady: In Q4, single-tenant net lease cap rates rose just one bp to 6.81%. Retail dipped to 6.55%, office climbed to 8.00%, and industrial held at 7.20%. Despite Fed rate cuts, pricing remained steady, signaling a break from short-term policy influence...

13-story hotel gets green-light at 4200 Century Blvd. in Inglewood

The City of Inglewood has signed off on a project which would replace the 135-room Tradewinds Hotel on Century Boulevard with a larger mixed-use building.

Gregory Peck of Beverly Hills-based Crescent Hotel Group, the applicant attached to the project at 4200 W. Century Boulevard, has proposed the construction of a 13-story, 335,000-square-foot building containing:

- 11 condominiums on floors 9-12;

- 118 extended stay hotel rooms on floors 7-12;

- 175 hotel rooms on floors 3-6; and

- event space, a lobby, a bar, and restaurant space on floors 1-2.

Retail Leasing Strategies Evolve in Uncertain Economy

According to Globe St, retailers are moving away from traditional, long-term leasing models in response to a dynamic economic landscape. Rather than treating retail leases as static occupancy costs, companies are viewing them as strategic tools to maximize flexibility and bargaining power. The approach allows retailers to better respond to everything from changing consumer trends to broader financial pressures...

Store Expansion News: December update

Retailers and restaurants alike made headlines to close out 2025 in December with store expansions and new formats.

Here are the major stories as reported by Chain Store Age, starting with the most recent.

- Report: Barnes & Noble to open 60 stores in 2026 The bookseller plans to open 60 new locations across the country in 2026, reported USA Today. According to a list obtained by the publication, Barnes & Noble plans to open stores in Ohio, Texas, Florida, Illinois, Colorado, Washington state, California, Virginia, Georgia and Washington D.C., with "several openings" scheduled between now and June 2026...

Kroger is ready to grow again in Houston area

Kroger’s only activity in the Houston area over the past few years has involved store closings and some remodels, but that is about to change.

The Cincinnati-based grocer plans to open several stores in the Houston area and continue remodeling existing locations, according to the Houston Business Journal.

Kroger did not respond to a request for comment.

Five Houston-area Kroger stores closed in 2025. During that time, the grocer combined its Houston and Dallas divisions to form a new Texas Division...

Benihana plans to get bigger, faster in San Francisco Bay Area following success

Benihana, the Japanese restaurant chain known for its teppanyaki dining style, is plotting an expansion in the San Francisco Bay Area.

The brand’s parent, publicly traded Denver-based One Group Hospitality Inc., signed a seven-year deal with an “experienced operator” to open 10 Benihana locations around the region, including three Benihana franchises, two Benihana joint-venture locations and five Benihana Express outlets...

Retail Media Platforms Redefine Store Strategy

Retail spending trends remain surprisingly robust, with holiday-period sales increasing by around 4% year-over-year, according to Mastercard and Visa data. However, Globe St reports that once inflation is accounted for, this growth flattens, revealing that Americans are spending more dollars but not necessarily purchasing more goods. These trends come amid declining consumer sentiment since April 2024, underscoring growing uncertainty in the retail sector...

Underwriting Standards Tighten for 2026 Refinancings

According to Globe St, commercial real estate lending in 2026 is shaping up as a ‘sorting year,’ with banks, CMBS, and private credit outlets applying far tougher underwriting standards. The backdrop: higher-for-longer rates, mounting maturities, and a thirst for strong sponsorship and financeable assets.

According to Trepp’s research, deals supported by robust cash flow and experienced sponsors are passing the new underwriting hurdles. Marginal assets, particularly those with optimistic past assumptions, face stricter debt service coverage requirements and heightened scrutiny...

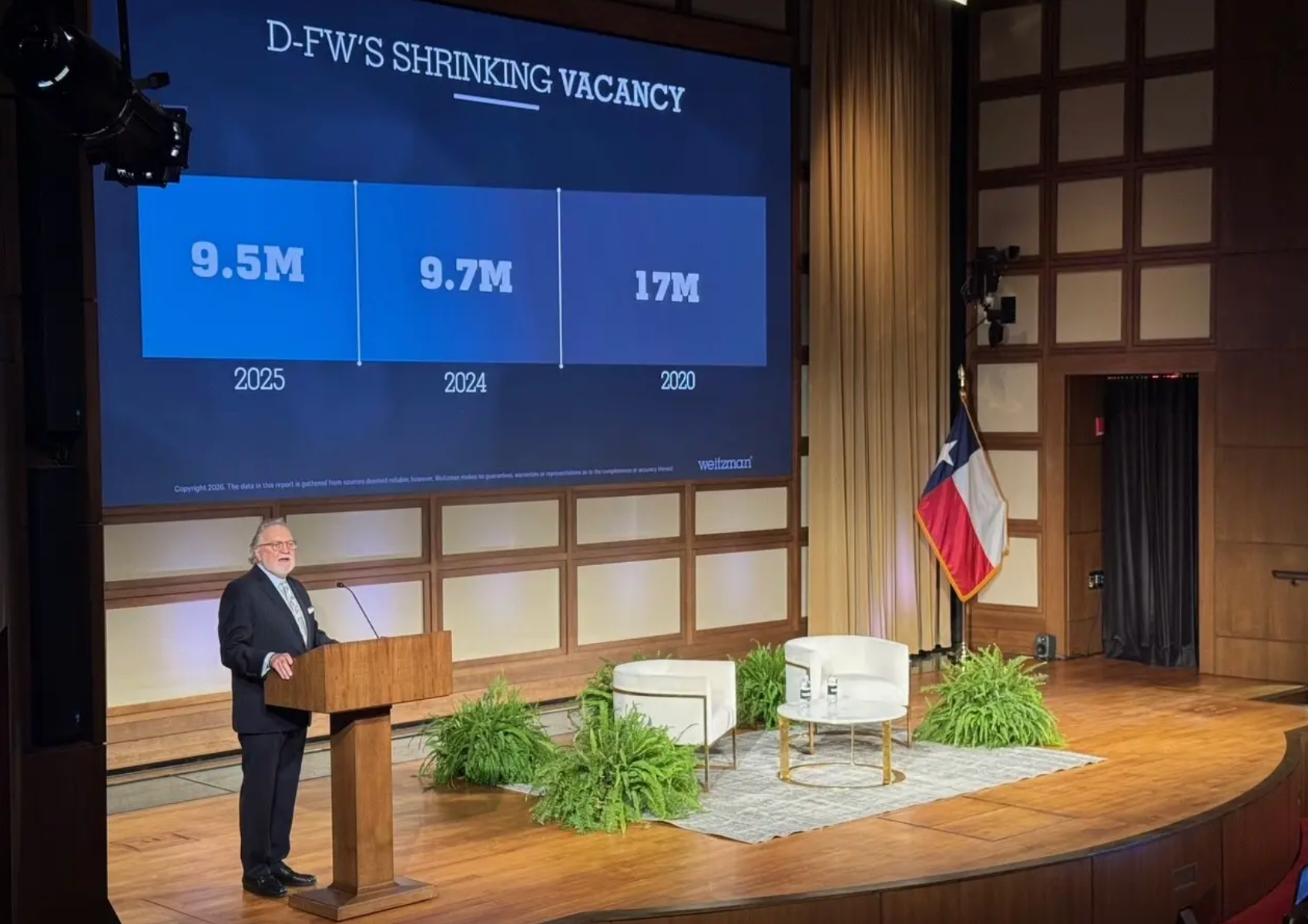

Grocers lift North Texas to nation’s top market for new retail construction

The Dallas-Fort Worth region is the nation’s top market for new retail construction, spurred by an ever-growing number of grocers seeking to capitalize on people moving to Texas.

North Texas has 7.6 million square feet of new retail projects in the pipeline — roughly twice the amount of the No. 2 U.S. market, which is Phoenix with 3.6 million square feet, according to CoStar’s latest data...

Jollibee’s International Business Could Go Public in U.S.

Jollibee Foods Corporation (JFC) announced plans to spin off its international business and take it public on a U.S. securities exchange, according to a filing with the Philippine Stock Exchange.

The company said in a news release that it’s working with international and local advisors on defining the structure and timing of the separation and upcoming U.S. listing. The transaction is expected to occur in late 2027. JFC acknowledged that the strategy could change and there is no assurance an actual separation will occur...

Salad and Go to Close 32 Stores, Exit Texas and Oklahoma Markets

Salad and Go, once a fast-rising drive-thru chain, announced the impending closure of 32 restaurants.

The brand is exiting its Texas and Oklahoma markets, which house 25 and seven stores, respectively. Going forward, Salad and Go will shift focus toward its Arizona and Nevada trade areas.

The news comes after the chain announced in September the closure of 41 restaurants across Texas...

GameStop reportedly closing up to 200 stores

GameStop continues to shrink its brick-and-mortar portfolio.

The struggling video game retailer revealed in a December 2025 Securities and Exchange filing that it planned to close a "significant number of additional stores" during the rest of its 2025 fiscal year, which ends on Jan. 31, 2026. Although GameStop has not disclosed the exact number of stores planned for closure, reports from local media and customer notices indicate that up to 200 stores could go dark...