Weekly Perl: A Commercial Real Estate News Recap

The continuous downfall of the Third Street Promenade

Residents of Santa Monica are no longer taken aback by the crippling state of the Third Street Promenade – for some it is a normalcy they have always known, and for others, it is a fall from grace they have come to accept.

Kroger to launch superstore concept in retail-starved Denver suburb

Grocery giant Kroger is looking to match supersized population growth with plans to debut its superstore concept in a Denver suburb where retail development has lagged far behind its residential boom.

Circle K owner considers selling 2,000 US stores as part of potential 7-Eleven deal

The parent company of 7-Eleven said Alimentation Couche-Tard agreed to consider divesting about 2,000 Circle K stores in the United States to address potential antitrust concerns that could torpedo a merger of the companies.

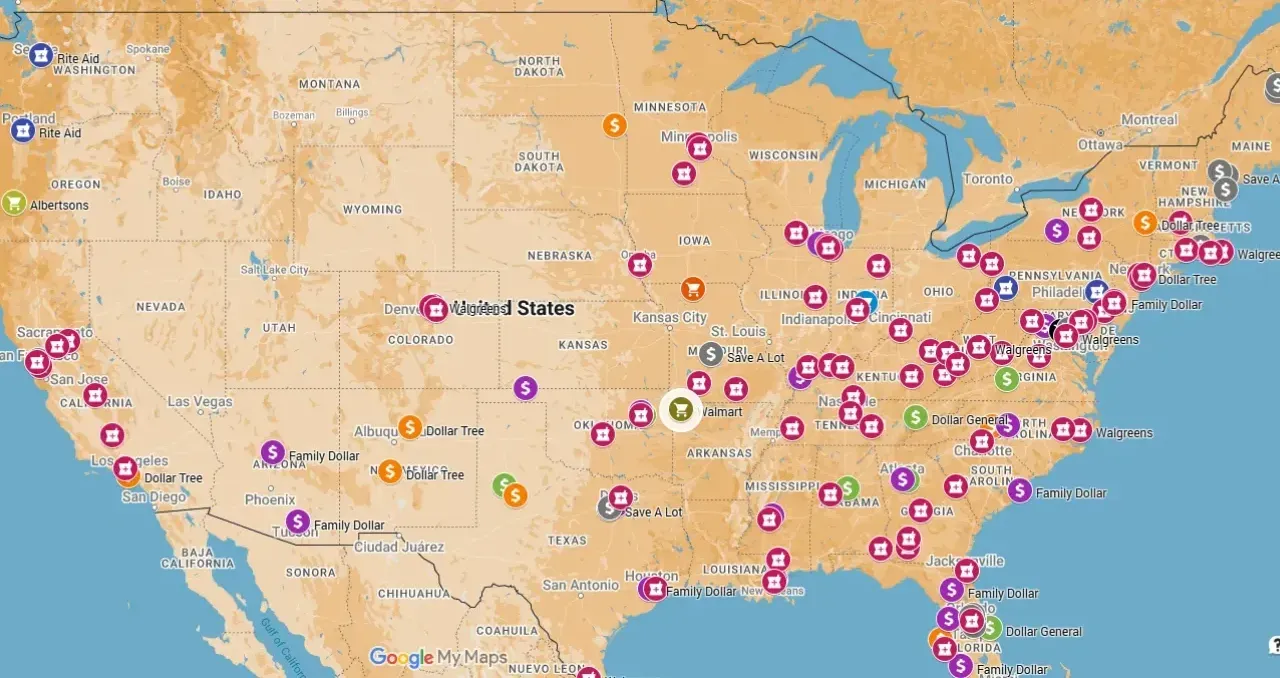

Dollar stores surge, Walgreens retreats in new store map

February was another big month for dollar stores across the U.S., with 122 opening and 37 closing, according to the monthly Supermarket News store map.

Walgreens in $10 billion deal to go private

The struggling retail pharmacy giant has entered into an agreement with Sycamore Partners to be acquired for an equity value of around $10 billion. Upon completion of the deal, Walgreen’s common stock will no longer be listed on the Nasdaq Stock Market, and it will become a private company.

CVS plans test of small-format stores

CVS Health is planning to open “a dozen or more” smaller-format CVS Pharmacy locations in markets around the country during the next year, a spokesperson for the retailer told Supermarket News.

Jack in the Box reveals opening timeline for 10 new restaurants in Chicago, suburbs

The iconic fast-food chain Jack in the Box will return to the Chicago area this summer with as many as 10 new restaurants set to open in the city and the suburbs, the company said in a release.

Retail’s 2025 Outlook: A Tale of Diverging Trends

This year’s outlook for the retail sector and its bricks-and-mortar locations is decidedly mixed, strikingly so across different categories, according to Datex Property Solutions’ latest report.

Dollar Stores Fight for Relevance Amid Stiffer Competition, Tariffs

Online portals like Temu and Shein — never mind old standbys like Walmart and Costco — have eaten into the record sales dollar retailers enjoyed during COVID-19

Costco on tariffs: Margins are much tighter on food

Costco did not seem overly concerned about the Trump administration’s 25% tariffs on Canada and Mexico during its second-quarter earnings call on Thursday, but it reminded shareholders that grocery items will be particularly vulnerable.

BJ's Wholesale Club to make big move into Texas

A new wholesale club is looking to expand into Texas for the first time, taking on rivals Sam's Club and Costco.

Jollibee launches first U.S. franchise program

Quick-serve chain Jollibee is looking to expand its store count — through franchising.

Gap reports strong Q4 as turnaround shows no signs of slowing

Gap Inc. maintained its turnaround momentum during the holiday quarter, reporting sales and earnings that topped Street expectations and a big comp sales increase across its namesake division.