Weekly Perl: A Commercial Real Estate News Recap

Smoothie King plots 90-plus new openings for 2026

The world’s largest smoothie franchise isn’t planning on slowing down its growth after a strong 2025.

Smoothie King says it plans to open more than 90 new store openings in 2026, in addition to launching a targeted franchisee incentive program spanning several key states, including Arizona, Illinois, Massachusetts, Michigan, Pennsylvania, Virginia and more. Through the program, Smoothie King says it is offering financial incentives to “growth-minded franchisees,” designed to accelerate brand awareness and density in these markets...

Whole Foods Expansion Boosted by Amazon Store Conversions

Amazon is making a decisive shift in its grocery division, announcing plans to shutter its Amazon Fresh supermarkets and Amazon Go convenience stores. Select locations from these chains will be repurposed as new Whole Foods Market stores, per CNBC. This move represents the latest in a series of strategic adjustments to grow Amazon’s presence in the US grocery market...

FAT Brands Enters Bankruptcy Amid Debt Struggles

FAT Brands filed for bankruptcy on Monday as it seeks to restructure more than $1.4 billion in debt tied to an aggressive acquisition strategy, according to court documents.

The filing includes FAT Brands, Twin Hospitality Group (parent of Twin Peaks and Smokey Bones), and dozens of affiliated entities. The company intends to continue operating normally while negotiating with lenders. Trading of FAT Brands’ shares will continue with a “Q” suffix, which signals the company is in bankruptcy proceedings and that the stock carries higher risk...

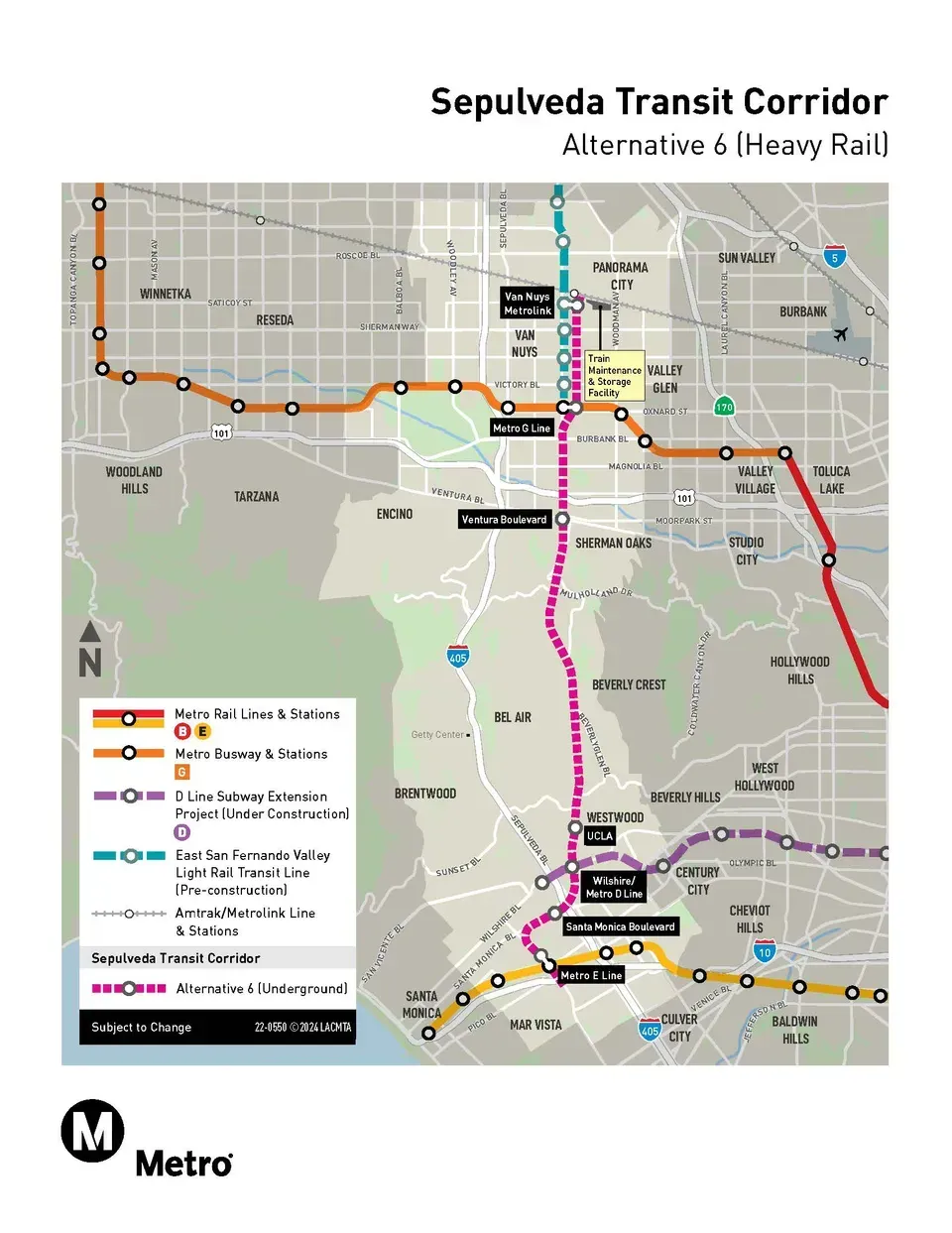

Metro approves underground rail line through the Sepulveda Pass

The Los Angeles County Metropolitan Transportation Authority Board of Directors has unanimously approved an all-underground heavy rail subway as the preferred route for the Sepulveda Transit Corridor, selecting a nearly 13-mile alignment designed to connect the San Fernando Valley with the Westside in under 20 minutes...

Paris Baguette plots big expansion for 2026 — and beyond

Paris Baguette is touting 2025 as its most successful year yet as it continued to expand its footprint of cafes.

The global bakery cafe chain opened 77 new stores last year, including a record of 14 in December alone. It also signed 101 new leases for future locations and signed nearly 300 development agreements...

PayMore to open 90-plus stores in 2026 — here's where

PayMore has its sights set on continued growth in the new year.

The buy-sell-trade electronics franchise plans to open 96 new stores across the United States and Canada in 2026, an average of eight new openings per month (full list at end of article). Last year, PayMore reached 100 stores, and the company has no plans of slowing down its expansion...

Bain & Co.: U.S. retail sales to grow 3.5% in 2026

Retail sales growth will slow in the U.S., U.K., France and Germany in 2026.

That’s according to Bain & Company’s 2026 Global Retail Sales Outlook, which projects U.S. retail sales will grow 3.5% year over year in 2026, to $5.3 trillion, slightly down from estimated 4.0% growth in 2025. Volume growth will be modest, with inflation projected to hover between 2.6% and 3.0%...

Retail Openings Edge Up as Closings Slow in 2026

According to CoStar, despite early-year headlines about Macy’s, Saks Global, and Francesca’s shuttering stores, US retail openings are set to tick upward in 2026. Industry analysts from Coresight Research and Telsey Advisory Group both forecast a modest increase in new store launches, with projections in the 1.4% to 4% range compared to last year. Store closings, while still significant, are expected to decelerate after a year that outperformed liquidation expectations...

BJ’s opening three stores in January — including smaller-format concept

BJ’s Wholesale Club’s expansion plans for January include the opening of its second smaller-format location.

The membership warehouse club retailer will open its second location under the BJ’s Market banner on Jan, 30, in Delray Beach, Fla. At 55,000 sq. ft., the store is about half the size of a BJ’s club. The smaller footprint is designed to offer a convenient grocery shopping experience featuring essential fresh foods, produce, sundries and seasonal products...

Target in big expansion of beauty — complete with new in-store experience

Target continues to expand and elevate its beauty profile.

The retailer is expanding its assortment with nearly 3,000 new products, and more than 60 new brands. More than 90% of the items are priced under $20, according to Target...

Starbucks upbeat; posts first U.S. comp sales growth in two years for Q1

Starbucks Corp.'s turnaround appears to be gaining increased momentum.

The coffee giant reported its first quarter of North America and U.S. same-store sales growth in two years in the period ended Dec. 28. North America and U.S. comparable store sales rose 4%, driven by a 3% increase in comparable transactions and a 1% increase in average ticket...