Weekly Perl: A Commercial Real Estate News Recap

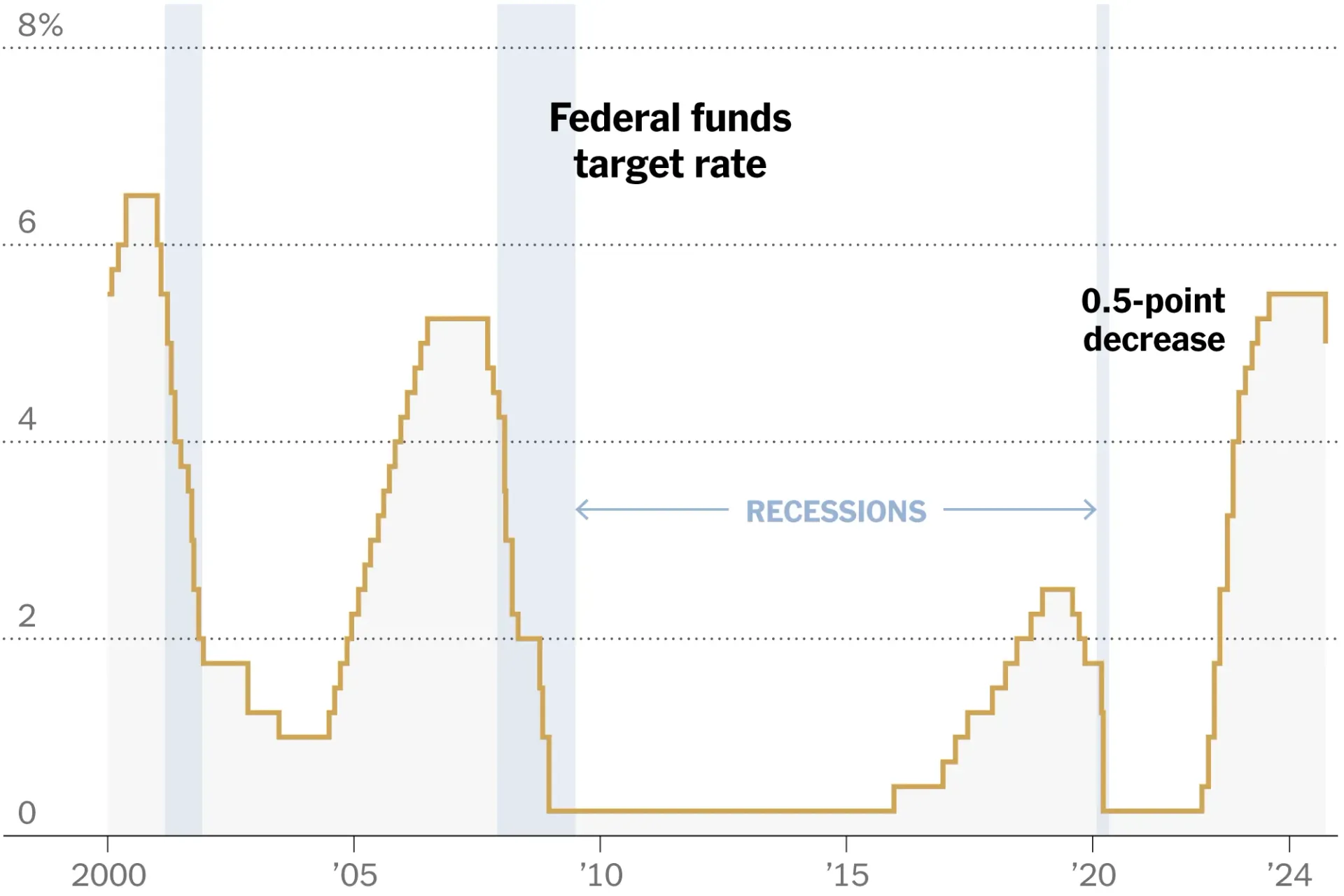

Fed Announces Big Rate Cut

We concluded that this was the right thing for the economy and the people we serve,” the Federal Reserve chair, Jerome Powell, said, referring to the central bank’s decision to cut interest rates by half a point.

U.S. Inflation Eases to Lowest Level in Three Years

The consumer price index for August rose 0.2%, as expected, and 2.5% year-over-year, below forecasts for a 2.6% rise and a notably cooler pace than the 2.9% reading in July – the smallest increase since January 2021 and the fifth straight pullback. Core CPI inflation, excluding food and energy, rose 0.3% in August versus expectations of 0.2% and 3.2% from a year ago, reported the Bureau of Labor Statistics (BLS).

As it Returns to Growth, A&W’s Quality Remains its Value Proposition

There’s been some industry chatter lately of “getting to the other side.” Hold fort on price, as much as possible, and withstand soft traffic until consumer confidence rebounds on the downslope of inflation. It’s not an unfamiliar story. A&W has been around 105 years and navigated two pandemics, the Great Depression and Recession, and countless economic and societal twists along the way.

Culto flagship shoe store to open on Santa Monica's Third Street Promenade

A Mexican footwear retailer is opening a store in Santa Monica as its first outpost in the U.S.

Santa Monica is the most expensive city to conduct business according to study

The cost of doing business in Santa Monica is exorbitantly high compared to other cities according to a new study published by Claremont McKenna College’s Rose Institute of State and Local Government.

Boba brand brings high-quality tea to Promenade

Originally concocted in 1980s Taiwan, the country is still bubbling with excitement over the product today, leading to Ronald Chan and Patrick Sun opening Odd One Out in 2022.

Americans are not feeling very positive about grocery, restaurants

For just the second time in nearly a quarter century, consumers aren’t feeling very happy about grocery stores, according to the latest Gallup Work and Education survey.

August grocery sales climb 7% YOY to $9.9B

The U.S. online grocery market ended August with $9.9 billion in monthly sales, a 7% increase over last year as all three fulfillment methods posted year-over-year sales growth according to the most recent Brick Meets Click/Mercatus Grocery Shopper Survey fielded August 30-31.

Groundbreaking for Costco, apartment development in South Los Angeles slated for this week

The groundbreaking for a new mixed-used apartment development, which will bring the first Costco to South Los Angeles and 800 new apartments, is slated for Wednesday.