Weekly Perl: A Commercial Real Estate News Recap

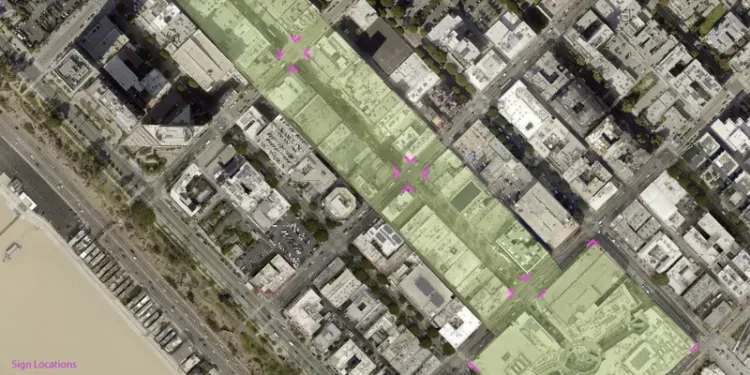

Santa Monica Considers Digital Billboard District for Third Street Promenade

Santa Monica planning commissioners on Wednesday reviewed a controversial proposal to allow up to 16 large digital billboards on the Third Street Promenade and Santa Monica Place, generating significant debate over historic preservation, public safety and economic recovery efforts...

Tractor Supply upping store growth in 2026

Tractor Supply Company remains in expansion mode.

The nation’s largest rural lifestyle retailer reported record sales for its third quarter, during which it opened 29 stores. It's on track to open a total of 90 locations for the full year. Tractor Supply is ramping up its growth next year, with plans to open 100 new stores, CFO Kurt Barton said during the company’s third-quarter earnings call...

Chi’s plan to save the city unanimously approved by Council

The Santa Monica City Council unanimously approved a comprehensive realignment plan Tuesday aimed at restoring public safety, revitalizing the downtown core and achieving fiscal stability by 2028, marking what officials called a pivotal moment for the coastal city's recovery from years of pandemic-era decline...

Carter’s to close 150 ‘low-margin’ stores, cut staff

Carter’s Inc. is upping its store closures and reducing staff as part of its ongoing effort to “right size” its cost structure and improve productivity as tariffs weighed on its profitability.

The nation’s largest apparel company dedicated to babies and young children now plans to close approximately 150 stores at lease expiration in North America during the next three years, an increase from its previously-disclosed target of approximately 100 locations. About 100 stores will go dark over the fiscal year 2025 and 2026 periods. The 150 stores collectively represent approximately $110 million in annual net sales on a last 12 months basis...

Boot Barn saddles up for expansion, aims to double store count amid Western wear boom

Riding the Western wear craze, retailer Boot Barn has raised its target for stores to 1,200 locations, 300 more than its original goal and more than twice its current fleet.

The Irvine, California-based chain, with 489 brick-and-mortar retail sites now, said it was stepping up its expansion plans after a market analysis it conducted...

VenHub opens autonomous convenience store at L.A.'s Union Station

A major travel hub is now home to a new 24/7 autonomous convenience store.

VenHub Global, a developer of fully autonomous retail technology, has announced the opening of its newest "smart store" at Los Angeles Union Station, the largest railroad passenger terminal in the Western United States and one of the nation’s most iconic transportation hubs...

Yum Brands reviewing options for Pizza Hut — including sale

Yum Brands is undertaking a formal review of strategic options for its Pizza Hut brand, which could include a potential sale.

In a statement, Yum Brands said the intent of the review was for Pizza Hut “to reach its full potential for the benefit of its franchisees, consumers, and employees and to maximize value for Yum shareholders...“

Denny's to be taken private in $620 million deal by owner of TGI Fridays, P.F. Chang's

Casual-dining chain Denny’s is getting taken private in a deal valued at about $620 million by a group that includes the owner of TGI Friday's and P.F. Chang's.

Denny’s as of June 25 operated nearly 1,500 mostly franchised restaurants worldwide, with a portfolio that includes 74 locations of Keke’s Breakfast Cafe, a chain that's also mainly franchised. The buyers are New York-based private equity firms TriArtisan Capital Advisors and Treville Capital Group, as well as Yadav Enterprises, an owner and operator of about 550 restaurants nationwide and one of the largest franchisees of both Denny's and Jack in the Box...

Urban Outfitters takes aim at Gen Z with new store format

Urban Outfitters is rolling out a new concept to more stores in a bid to cater to Gen Z shoppers’ local preferences and a refreshed design.

The Philadelphia-based retailer last week brought the format to the Glendale Galleria in Glendale, California, following a debut last month at Citycentre in Houston. The new format is slated to expand to a third store next month, at the Westfield Montgomery Mall in Bethesda, Maryland. And it will launch at an additional seven locations across the United States next year, according to Urban Outfitters...

Publix Q3 sales rise 5.8%

Publix reported third-quarter growth across both its top and bottom lines.

Net earnings totaled $1.2 billion, or $0.37 per share, for the quarter ended Sept. 27, up from $1.1 billion, or $0.33 per share, for the year-ago period. Adjusted earnings were $980 million, or $0.30 per share, compared to $930, or $0.28 per share, in 2024...

Chick-fil-A opens new restaurant concept

Chick-fil-A is branching out.

The popular quick-serve restaurant chain has debuted a new restaurant concept, called Daybright, featuring an array of specialty coffee drinks and some food items, reported AtlantaNewsFirst.com. Located in the Atlanta suburb of Hiram, Ga., the concept was created by Chick-fil-A innovation subsidiary, Red Wagon Ventures...