Weekly Perl: A Commercial Real Estate News Recap

CEO of American Realty Advisors elected to Downtown Santa Monica board

Stanley Iezman has been elected to the board of Downtown Santa Monica, Inc. (DTSM), filling the vacant property owner seat left open after the resignation of longtime board member Julia Ladd.

The results were announced Thursday by DTSM CEO Andrew Thomas, who praised the caliber of candidates and the level of engagement from the downtown property ownership community...

Mid-Year Recap: Retailers continue to expand despite challenges

From C-suite shakeups and bankruptcies to sticky inflation, tariff threats and anxious consumers, it’s been a challenging year so far for the retail industry. Uncertainty seems to be the dominant theme, among consumers and retailers alike...

Friendly’s parent company Brix Holdings acquired by franchisee

Brix Holdings — the 250-unit parent company to Friendly’s Restaurants, Clean Juice, Red Mango, and Orange Leaf — has been acquired by Legacy Brands International, an investment group managed by multi-unit Friendly’s franchisee, Amol Kohli...

Trader Joe’s continues to crank out store openings

Trader Joe’s plans to open 30 new stores across 18 states in the coming months.

Texas, California, and New York are each expected to receive three locations. Louisiana, Massachusetts, Oklahoma, and Utah will get two stores each. Trader Joe’s also has plans for locations in Arizona, Colorado, Connecticut, Washington, D.C., Florida, Georgia, Missouri, New Jersey, Oregon, South Carolina, and Virginia...

Del Taco to reopen 17 Colorado locations

The nation’s second-largest quick-serve Mexican restaurant chain is returning to a key market.

Del Taco is in the process of a phased reopening of 17 corporate-owned locations across Colorado. The rollout began June 21 and will continue throughout the next several months. With five locations now reopened and 12 more scheduled, the brand says it is reestablishing its footprint in communities “eager for its bold flavors and beloved menu items...”

Nordstrom Rack adds five new stores to 2026 lineup — here are the locations

Nordstrom continues to expand its off-price division.

The department store retailer, which in May closed on its deal to go private, is on track to open 21 Nordstrom Rack stores this year. It expects to open roughly the same amount in 2026, and has already announced a handful of openings, including a 30,000-sq.-ft. store at Turkey Creek in Knoxville, Tenn., and a 27,000-sq.-ft. store at Sarasota Pavilion in Sarasota, Fla...

Retailer At Home decides to keep open some US stores it previously planned to close

At Home has decided to keep two of its U.S. stores open despite initial plans to close them as the retailer seeks more time to assume or reject its real estate leases through a Delaware bankruptcy court.

The home goods retailer based in the Dallas area is also getting more funds as it navigates bankruptcy proceedings. Judge J. Kate Stickles granted At Home access to up to $600 million of debtor-in-possession financing, including $200 million of new funding and $400 million of prepetition debt...

Stater Bros. on a roll with new stores

It’s been a big summer for Stater Bros. Markets with the San Bernardino, Calif.-based grocery retailer opening a new store in Highland, Calif., and renovating another location in Twentynine Palms, Calif.

The grocery chain, which operates 166 stores, as of July 15, according to Scrapehero.com, announced on July 17 that it has completed the renovation of the Twentynine Palms store...

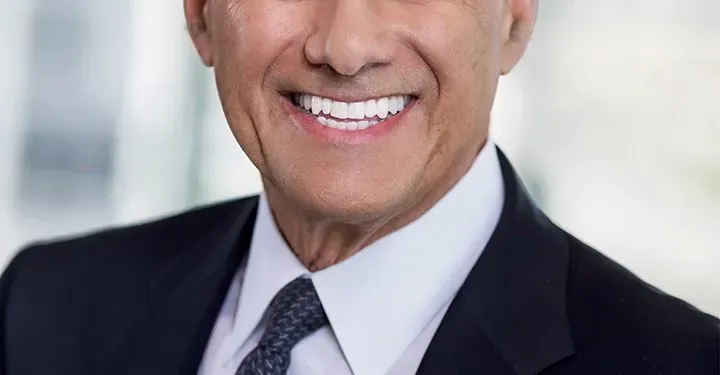

100 Days In, Church’s CEO Roland Gonzalez Has a Story to Tell

As CEO Roland Gonzalez explains it, Church’s Texas Chicken had to get its house in order. But now, the brand is no longer on the cusp; it isn’t a turnaround anymore. “We’re full steam ahead and we’re going to accelerate,” says Gonzalez, the chain’s former COO, who recently completed his first 100 days atop the brand...