Weekly Perl: A Commercial Real Estate News Recap

Taco Bell Stays Hot as Sales Continue to Rise

Taco Bell remains unfazed by macroeconomic pressures.

The Mexican giant’s U.S. same-store sales lifted 7 percent in the fourth quarter—fueled by transaction growth—and it continued to grab market share. Also, system sales lifted 8 percent and core operating profit rose 10 percent. The favorable financial results are coming from a variety of sources, including higher-income customers, families, and younger guests (the brand’s highest penetration of consumers came from 18 to 24-year-olds)..

First Look: Thursday Boot Company ramps up store growth

Direct-to-consumer footwear brand Thursday Boot Company is entering its next chapter by expanding its physical footprint.

Founded in 2014, the company has unveiled its first-ever West Coast store, in the Hayes Valley neighborhood of San Francisco. It’s the brand fifth location to date, with two stores in New York City, one in Chicago, and one at Garden State Plaza in Paramus, N.J...

Savvy Sliders Finds Big Opportunity in Small Burgers

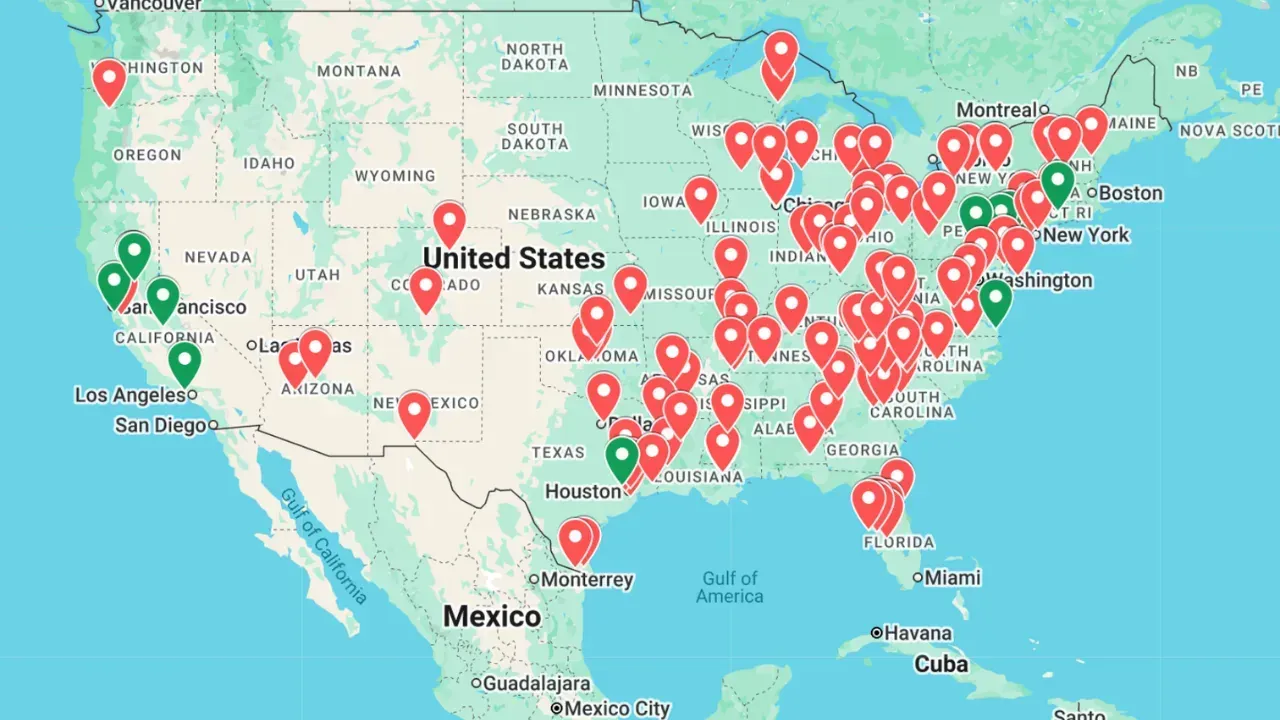

Savvy Sliders has 57 stores in the U.S.

Happy Group COO Sonny Asker likes to describe Savvy Sliders as a “disruptive” concept.

Since its founding in 2018, the fast casual has opened 57 restaurants, and there are 60 more units in development. The brand was born out of Michigan, but has spread to existing/upcoming markets like Illinois, Nevada, Indiana, Florida, Texas, North Carolina, and Louisiana. The goal is to open approximately 35 restaurants in 2026. Savvy Sliders is moving at a pace of two to three openings per month, and Asker wants to ramp that up to four...

Bob Evans Restaurants acquired

Bob Evans Restaurants has a new owner.

New York-based investment firm 4x4 Capital has acquired the 78-year-old, Ohio-based family-dining chain from Golden Gate Capital. Bob Evans has more than 400 locations in 18 states. Golden Gate acquired the company in 2017

Thousands of apartments set to take over empty office buildings with new L.A. ordinance

Los Angeles officials just made it easier to convert empty commercial buildings to housing, opening the door to the creation of thousands of apartments across a city clamoring for housing.

Developer Garrett Lee is already rolling.

After years of struggling to find white-collar tenants for a gleaming office high-rise on the edge of downtown, he has just begun converting its office space into close to 700 apartments..

Love’s Travel Stops to invest $700 million in new locations, remodels

Love’s Travel Stops is focused on growth and reinvestment in 2026.

The travel store and convenience-store company, which has 668 locations in 42 states, plans to invest $700 million in building new locations and remodeling existing ones under its “Road Ahead Plan” strategy. Under this initiative, more than half of Love’s locations will be newly constructed or remodeled by 2035...

Eddie Bauer, Francesca's seek last-minute buyers as they close nearly 600 stores

Two struggling U.S. retailers, Eddie Bauer and Francesca's, each filed for bankruptcy protection and plan to close their combined roughly 600 stores if they don't find last-minute buyers for their separate businesses.

Bellevue, Washington-based Eddie Bauer, a supplier of outdoor apparel and gear, on Monday said it had commenced voluntary Chapter 11 proceedings in the U.S. Bankruptcy Court for the District of New Jersey. The company, with 175 stores in the United States and Canada, has drawn interest from two potential buyers for part of its operations, according to court filings. Eddie Bauer is looking to potentially use one of them as a stalking-horse bidder...

Dollar Tree Expansion Targets Affluent Areas

Affluent Areas Attract Dollar Tree

Dollar Tree is accelerating expansion into affluent neighborhoods, opening almost half of its new locations in higher-income ZIP codes over the past six years, per Bisnow. The discount retailer reached a milestone in Plano, Texas, with its 9,000th store, symbolizing its shift toward wealthier, suburban markets. In 2025 alone, a quarter of new Dollar Tree stores launched in areas where median household incomes exceed $100K...

Family Dollar wipes out 82 stores

Family Dollar went through another round of heavy store closings in the month of January. The discount store shuttered 82 locations, according to the latest data provided by ScrapeHero. Texas had the highest number of store closings with 9 followed by Tennessee and Ohio, which had 8 apiece...

Wonder Buys NYC Fast Casual Blue Ribbon Fried Chicken

Innovative food platform Wonder announced Tuesday that it has acquired Blue Ribbon Fried Chicken.

The fast casual’s menu—featuring fried chicken, wings, sandwiches, smashburgers, salads, and Tender Dogs (chicken tender on a hot dog bun)—will be offered at a Wonder location in New York City later this year. Other Wonder units will follow...