From Ashes to Action: The Surprising Rise of Retail Real Estate!

Hey, Retail Real Estate Rockstars! Let's dive deep into the current surge in retail real estate, proving to be the phoenix rising from the ashes of negative headlines. With insights from the economic gurus, Christine Cooper and Rafael De Anda of CoStar News, we've got a crystal-clear picture of why retail spaces are turning heads again.

Interestingly, even though some stores are closing and going bankrupt, the retail real estate market is doing quite well. This situation might seem strange, but it actually offers a unique perspective for those looking to get a better grasp of today's economy. For people who own retail real estate, paying attention to the economy and understanding what shoppers want can really help them find success and make smart choices with their investments.

Consumers Continue To Carry the Economy

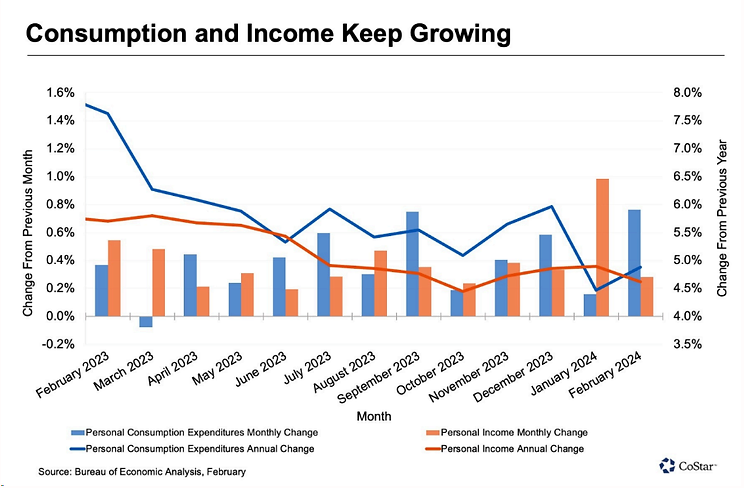

The economy started 2024 on a strong note, mostly because people are spending more money. Even though prices are high and people are dealing with more debt, folks still feel pretty confident about their financial situations. The economy is expected to grow between 2% and 2.5% during the first quarter of the year. This good start comes after a strong end to last year, where the economy grew faster than originally thought—up to 3.4% in the last quarter of 2023. Also, people spent 0.8% more in February compared to January, and this spending was almost 5% higher than the same time last year. [1].

Retail real estate is significantly impacted by this consumer-driven expansion, which highlights how crucial it is to comprehend and respond to these economic cues. Owners of retail properties should remember the following:

- Consumer Confidence is Key: People are spending more money these days, partly because the stock market is doing well, with a 10% increase. This boost in the market makes people feel wealthier, so they are visiting stores more often and spending more money there.

- Shift Towards Services: People are spending a lot more money on services now, which shows that their preferences are changing. They are particularly spending more on fun things like entertainment and travel. Because of this, places that sell these kinds of services or are near them might see more customers coming in.

- Automobile Sales and Beyond: The 3.9% increase in spending on cars and car parts in February shows that people are willing to spend more on both products and services. This trend could be good for stores that sell things related to cars or help improve them.

For those investing in retail real estate, it's important to understand the bigger economic picture. A strong job market supports steady consumer spending. In the past three months, there have been, on average, 265,000 new jobs added each month, and wages have been growing by at least 4% each year. However, investors should also watch for changes in interest rates, which are controlled by the Federal Reserve, as these can affect the economy too. [1]

The economy right now has both opportunities and challenges for those who own retail real estate. To do well in this constantly changing environment, owners need to use a smart plan that's based on the latest economic information and a deep understanding of what consumers want. Whether you're planning to buy, sell, or update properties, aligning your strategies with these economic trends can really pay off.

Call or DM me for more information on leveraging these insights to optimize your retail real estate portfolio.

With the retail real estate market looking good because people are spending more and interest rates might change in June 2024 or September 2024, how can property owners use these changes to their advantage?