March CPI Spike: Unlock the Secrets to Thriving Retail Spaces!

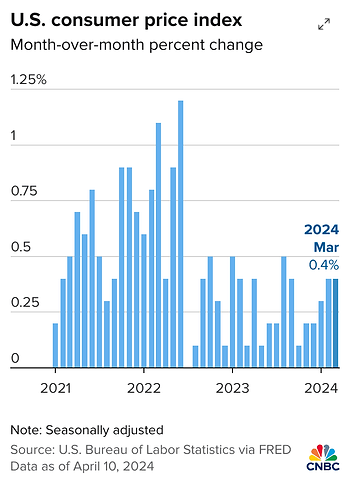

Hey, Retail Real Estate Rockstars! Dive into the March 2024 inflation scoop and its impact on your retail property investments. The US CPI rose by 0.4% month-over-month and, more notably, saw a year-over-year increase from 3.2% in 2023 to 3.5% in 2024. This stir in the financial pot is influencing everything from consumer spending power to the attractiveness of investing in retail real estate.

Here's why this matters to you:

- Consumer Spending Power: An uptick in CPI indicates that shoppers are still out there, spending away—music to the ears of retail spaces. Rising costs in gas, rent, and mortgages are putting pressure on household budgets, which could affect consumer behaviors and retail sales.

- Investment Appeal: Shifts in financial markets, like rising bond yields, could sway investors toward other avenues, impacting real estate values. Persistent inflation and the possibility of higher interest rates, as suggested by Jamie Dimon of JPMorgan Chase, indicate a tougher environment for cost-sensitive investments.

- Loan Interest Rates: The inflation data fuels speculation about interest rates, directly affecting your financing strategies for retail properties. The March CPI increase, coupled with a strong job market, may delay the Federal Reserve's anticipated rate cuts, influencing your decisions on refinancing or new acquisitions.

This year's rise in inflation and its potential to disrupt the Federal Reserve's rate reduction plans in June 2024 require a cautious approach. As Greg Friedman of Peachtree Group suggests, we might need to adjust expectations, as 3% could become the new norm over the previous 2% target. This shift in monetary policy could recalibrate asset values and open up opportunities in distressed assets.

Knowledge is your superpower. Understanding how broader economic trends, like inflation, affect the retail real estate market empowers you to make informed decisions, whether you're buying, selling, or holding onto your properties.

Call or DM me for more information. Let's leverage these insights to elevate your retail property investments.

How do you stay ahead in the retail real estate market amidst economic fluctuations and Fed rate speculations?