Weekly Perl: A Commercial Real Estate News Recap

Cannabis firm MedMen files for bankruptcy

MedMen is liquidating its California assets following a failure to clamp down on excessive debt, with its seventh CFO in a five year period exiting ahead of its bankruptcy.

THC users are more likely to order from these online retailers…

A recent study of present and past self-reported THC & CBD users from Numerator, "Budding Behaviors: Insights into the Modern Cannabis Consumer," reveals that compared to non-users, surveyed THC users are 61% more likely to have ordered from DoorDash, 35% more likely for Uber Eats, 31% for Little Caesars Pizza, 28% for Jersey Mike’s Subs, 22% for Taco Bell, 22% for Jack in the Box, 19% for Pizza Hut, 19% for Dominos, 17% for Wawa and 16% for Popeyes.

Burger King is Betting $300 Million More on Modernization Plan

Burger King on Tuesday morning shared better-than-forecasted sales as Q1 comps rose 3.8 percent on top of an 8.7 percent result from a year ago. Restaurant Brands International, which also owns Firehouse Subs, Popeyes, and Tim Hortons, posted revenue of $1.74 billion, which topped Wall Street predictions of $1.7 billion.

Domino’s has Built Momentum and Doesn’t Plan to Squander it

Domino’s CEO Russell Weiner called his company an “equal opportunity share stealer” to describe how the brand likes to compete in the marketplace. He admitted the chain lost that philosophy in the past couple of years. But thanks to “Hungry for More”—a series of self-help initiatives covering food, operations, value, and enhanced franchisees—the country’s largest pizza chain is starting to see customers return in droves. In the first quarter, Domino’s same-store sales rose 5.6 percent year-over-year, driven primarily by higher order counts.

A Decade Of Demolition Without Substantial Development Has Reset Retail

A great recalibration of the country’s retail footprint has been underway for years, as bankruptcies have roiled some of the most beloved stores and restaurant chains. Now, as other sectors of CRE stumble and slow, retail has stabilized as a result. Retail spaces in the U.S. have clocked record-low vacancy rates for more than a year, most recently settling at 4.1% in the first quarter, according to

CoStar.

Aldi opens new stores in Mississippi and Texas

Aldi continued its rapid expansion into the U.S. market with new stores opening in Pascagoula, Miss., and Texarkana, Texas, both on April 25.Both locations are open daily from 9 a.m. to 8 p.m., and for the grand opening weekend, shoppers can enter a sweepstakes for a chance to win a $500 Aldi gift card.

Tractor Supply Q1 sales hit record $3.4B amid comp increase, new store openings

Tractor Supply is maintaining its full-year financial guidance after reporting increases in first-quarter earnings and sales.The nation’s largest rural lifestyle retailer also confirmed its previously announced plans to open approximately 80 new Tractor Supply stores in 2024 as well as to continue its “Project Fusion” store remodels and garden center transformations.

Tropical Smoothie Cafe to be acquired in reported $2 billion deal

Tropical Smoothie Cafe is getting a new owner.Los Angeles-based private equity firm Levine Leichtman Capital Partners has entered into a definitive agreement to sell its portfolio company, Tropical Smoothie Café, to private equity funds managed by Blackstone. Terms of the transaction were not disclosed, but The Wall Street Journal reported that the deal values the fast-casual chain at about $2 billion.

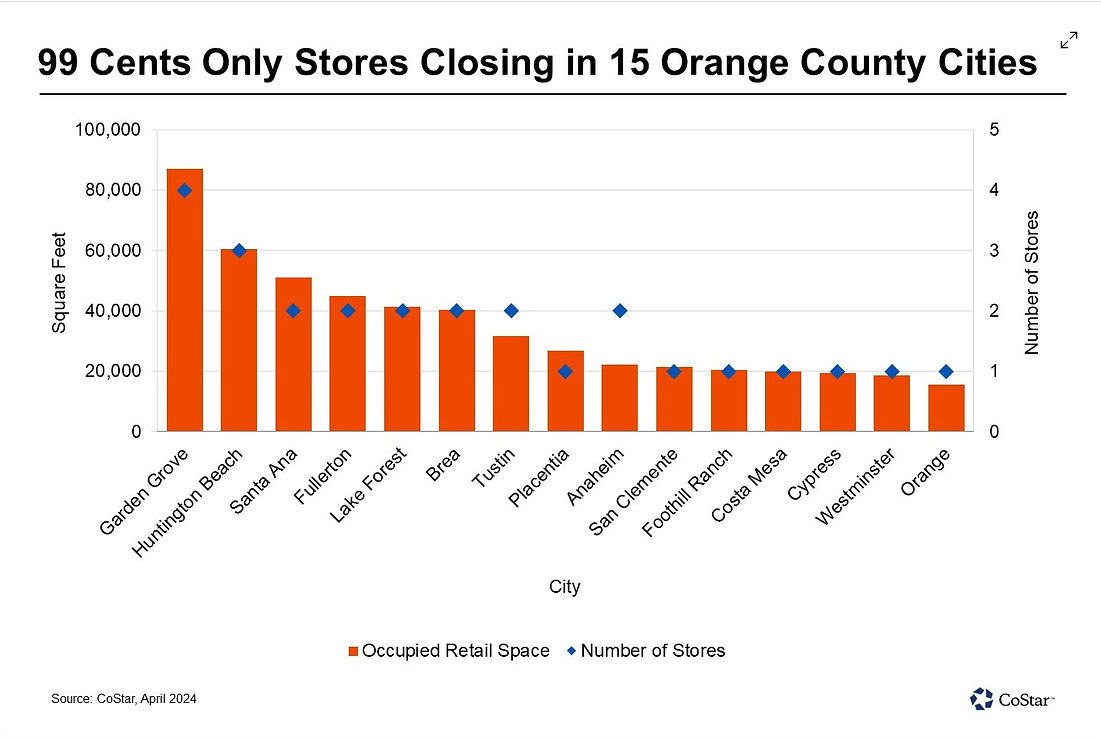

How Will 99 Cents Only Store Closures Impact Orange County?

In early April, discount retailer 99 Cents Only announced that it would close all 371 of its stores across Arizona, California, Nevada and Texas. The majority of those storefronts are in Southern California, where a group of investors led by the former president of Big Lots and CEO of Pic ‘N’ Save Bargains is positioning to reopen 143 stores, following the initial closures and liquidation sales. 99 Cents Only — which is seeking Chapter 11 bankruptcy protection — occupies more than 90 locations in Los Angeles County, nearly 50 in the Inland Empire, 26 in Orange County and just over 20 in San Diego County, according to CoStar research.

California Supreme Court Will Hear Arguments On Constitutionality Of Anti-ULA Ballot Measure

The California Supreme Court will hear arguments May 8 about the constitutionality of a measure planned for November’s ballot that would reverse Los Angeles’ real estate transfer tax and dozens of other recently enacted special taxes. The court got involved after Gov. Gavin Newsom and the state legislature petitioned to take the measure off the ballot, an intervention that groups on both sides of the measure say is unusual.