Weekly Perl: A Commercial Real Estate News Recap

NRF: January retail sales are ‘great’ start to new year

Consumers kept shopping in January. Retail sales in January nearly matched December’s busy holiday spending and rose significantly year-over-year, according to the CNBC/NRF Retail Monitor, powered by Affinity Solutions, released by the NRF.

Chipotle Speeds Toward Even Greater Heights

You could say Chipotle had an enviable problem. The brand’s digital growth out of COVID soared rewards membership over 35 million and loaded up the backline to the point where stores became unbalanced in staffing. In the summer of 2022 or so, Chipotle launched what it dubbed “Project Square One.” As it sounds, the notion was to return to basics on the in-store experience that helped Chipotle define a category over three decades ago.

Report: Inspire Brands Could Go Public in $20 Billion Valuation

According to a Wednesday report from Bloomberg, Inspire Brands-backer Roark Capital has held preliminary discussions with potential advisers to take the multi-concept giant public. An initial public offering would arrive in late 2024 or 2025, depending on market conditions, sources told the publication, with Inspire commanding a value of roughly $20 billion.

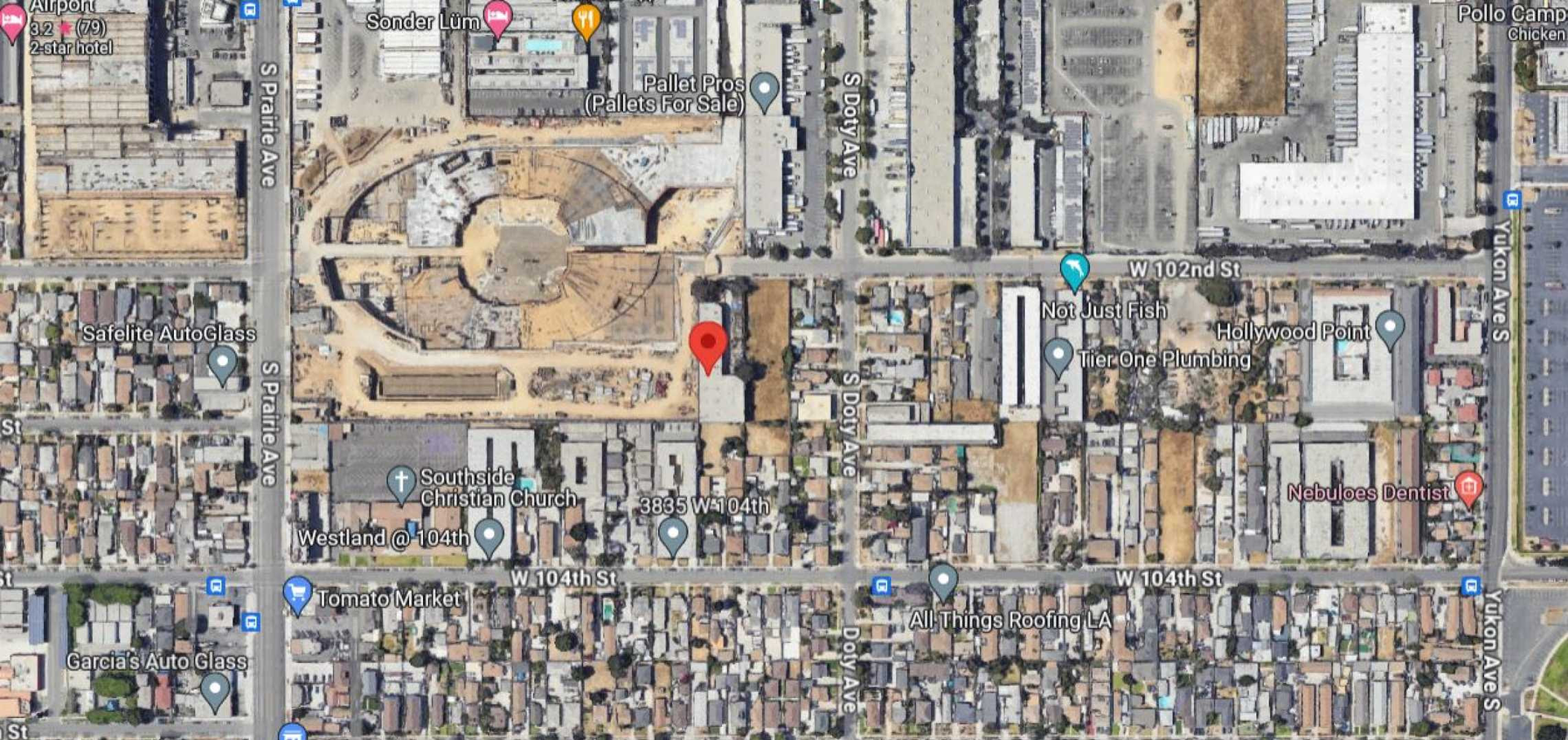

15-story hotel planned next to new L.A. Clippers arena in Inglewood

Just south of Intuit Dome, where the L.A. Clippers are scheduled to begin playing games next season, Los Angeles-based Arya Group, Inc. is planning a mid-rise hotel development which would rank among the tallest buildings in Inglewood. The proposed project, slated for a site at 3820 W. 102nd Street, calls for razing a low-rise commercial building to make way for a new 15-story, approximately 310,000-square-foot building featuring a 174-room hotel, 3,255 square feet of offices, 6,537 square feet of hotel restaurant space, 1,310 square feet of lounge space, a 4,000-square-foot private club, and 4,000 square feet of spa and amenity space.

Thanks to $400M Plan, Burger King Sees Guests Returning to Restaurants

The chain reported low-single-digit traffic growth in Q4, which was the first positive increase since Q2 2021. Also, U.S. same-store sales rose 6.4 percent, lapping 5 percent growth in the year-ago period. For the year, comps lifted 7.5 percent, rolling over 2.2 percent in 2022. Burger King franchisees are making more money as well. Average profitability per restaurant increased nearly 50 percent in 2023, moving from $140,000 to more than $205,000.

Kroger promises to lower prices, invest in stores following merger

The Kroger Co. has detailed its commitment to customers as it faces regulatory scrutiny over its proposed acquisition of rival Albertsons Cos. The supermarket giant said, consistent with its previous approach to mergers, it will lower prices following its merger with Albertsons. It plans to invest $500 million to lower prices following the close of the deal — starting day one. It also will also invest $1.3 billion to improve Albertsons' stores.

Legion averages 100 “engagements” a day during first month of downtown deployment

The newly hired private security company patrolling Downtown Santa Monica reported more than 3,000 interactions during its first month on patrol and while local businesses say the systemic problems persist, some say they’ve seen signs of improvement recently. During the first meeting of the Downtown Santa Monica Inc., (DTSM) Board of Directors for 2024, security company Legion Corporation, presented a report on its first month of operations.

Shipley Do-Nuts’ Texas Roots Blossom into National Success

He worked as the chief executive of Korean fast-casual Bonchon for four and a half years and in marketing roles at Wingstop for the same amount of time. One of his biggest memories—or nightmares, if you think about it—was the cyclical nature of the chicken market, where operators live and die by what the price is on any given day, week, or month.

Shell to acquire 45 convenience stores in New Mexico

Shell is expanding its U.S. retail footprint. The company has signed an agreement to acquire Brewer Oil Company’s (BOC) retail division, which includes 45 fuel and convenience store sites in New Mexico. The acquisition also includes traditional fueling stations and cardlocks for fleet vehicles.

World’s Largest Franchisee Flynn Group Explores Sale

Sources told Reuters that the majority interest could be valued at more than $5 billion, including debt. The company is working with Bank of America on the sales process. Flynn Group, founded in 1999 by industry veteran Greg Flynn, is the largest operator of Applebee’s, Arby’s, and Pizza Hut, and also owns hundreds of stores for Taco Bell, Panera, and Wendy’s. Altogether, the company oversees more than 2,600 units and earns more than $4.5 billion in annual sales.

Positioned for Success: Retail, dining segments to watch in 2024

Amid price hikes, rising interest rates and mounting consumer debt, the retail industry did pretty well in 2023 — certainly a lot better than some experts had predicted — as consumers continued to shop. As to what to expect this year, foot traffic analytics firm Placer.ai has dived into its rich treasure chest of data to find which segments are best positioned for success in 2024.