Weekly Perl: A Commercial Real Estate News Recap

Aldi, Trader Joe’s, and Lidl: Grocery's Power Trio

The grocery segment has never been more competitive, and Aldi, Trader Joe’s, and Lidl have consistently emerged as top players. The three chains share similarities: all offer a limited assortment of groceries and tend to operate at lower price points – however, each one is carving out its own distinct path to growth...

Tractor Supply sales rise 4.5%; maintains outlook despite ‘external pressures’

Tractor Supply reported a solid second quarter and sounded a confident note about its prospects for the rest of the year.

The nation’s largest rural lifestyle retailer is also ramping up its store expansion, with plans to open 100 new locations in 2026...ertainty seems to be the dominant theme, among consumers and retailers alike...

Trader Joe’s has 25-plus stores ‘opening soon’ — here are all the locations

Trader Joe’s continues to expand its retail footprint across the United States.

The popular grocer, which operates in 43 states and the District of Columbia, keeps a running list on its website of its upcoming locations, with the list updated on a regular basis. Recent Trader Joe’s openings include Northridge Calif., Sherman Oaks, Calif. and Westminister, Colo...

Mid-Year Recap: Retailers continue to expand despite challenges

From C-suite shakeups and bankruptcies to sticky inflation, tariff threats and anxious consumers, it’s been a challenging year so far for the retail industry. Uncertainty seems to be the dominant theme, among consumers and retailers alike...

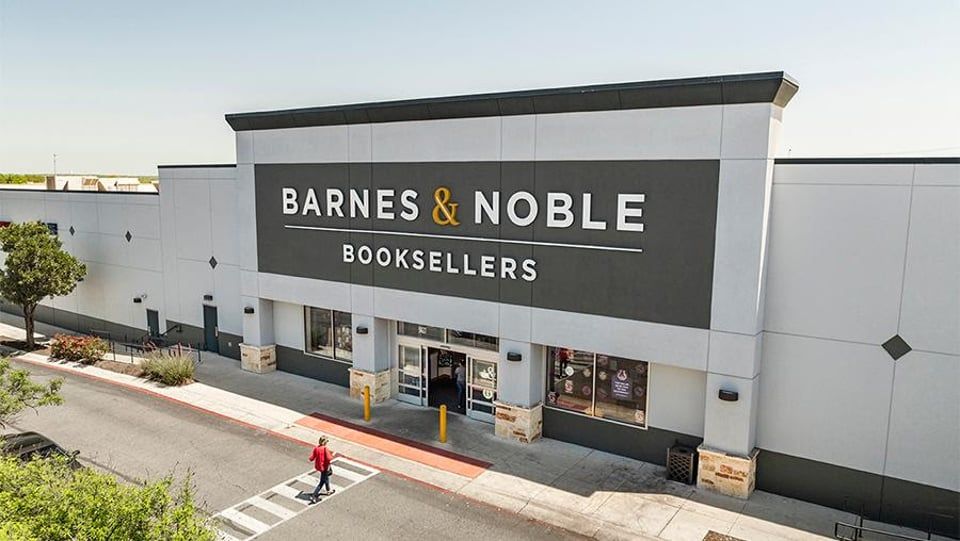

Barnes & Noble opens three new stores — here’s where

Barnes & Noble is furthering its expansion as the brick-and-mortar bookstore resurgence continues.

Open-air shopping center owner and developer Big V Property Group has announced the opening of three new Barnes & Noble stores at properties in Texas and South Carolina. All of the new locations — at Alamo Ranch in San Antonio and Southpark Meadows in Austin, and The Shoppes at Woodhill in Columbia, S.C. — were previously home to other retailers and were reconceived and remodeled to accommodate the retailer’s new, smaller format...

Lowe's continues Sunbelt expansion

Lowe’s is gearing up to open its fifth new store in 2025 as it expands its presence in the fast-growing Sunbelt region.

The home improvement giant will open a new location in Maricopa, Ariz. on July 25. The new Lowe’s store will feature approximately 94,000 sq. ft. of retail space, plus approximately 30,000 sq. ft. of outdoor garden space.

Shipley Donuts to open 40-plus new locations by end of 2025

Shipley Donuts is touting its store expansion efforts as well as sales growth.

The Houston-based donut chain, known for handmade fresh daily donuts and kolaches, marked its 18th consecutive quarter of positive sales growth in the second quarter of 2025, while expanding into two new states and opening 16 new locations throughout the first half of the year...

First Look: Martha Stewart launches first-ever stores

Add freestanding brick-and-mortar retail to the resume of the legendary Martha Stewart.

The world’s first Martha Stewart store has opened at City Centre Mirdif in Dubai, followed by a second location at the Dubai Hills Mall. The stores are operated through Marquee Brands, which acquired the Martha Stewart brand of home furnishings and other branded products and media in 2019. As part of the deal, Marquee said Stewart would continue to guide the brand she founded.

Buyer pays a near-billion dollars for 119 JCPenney stores

Copper Property CTL, a pass-through trust established to acquire 160 JCPenney stores and six distribution centers as part of the brand’s 2020 Chapter 11 filing, has found a buyer for 119 of them.

Copper Property has made a purchase and sale agreement with an unnamed affiliate of Onyx Partners, a Needham, Mass., investment collaboration firm, to purchase all 119 properties for $947 million in cash...

Consumer confidence inched up in July

Consumer confidence rebounded slightly in July as Americans felt more optimistic about the future even as they continued to worry that tariffs would lead to higher prices.

The Conference Board’s Consumer Confidence Index rose by 2.0 points in July to 97.2 from 95.2 in June. The Present Situation Index — based on consumers’ assessment of current business and labor market conditions — fell 1.5 points to 131.5. The Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — rose 4.5 points to 74.4...