Weekly Perl: A Commercial Real Estate News Recap

Measure ULA gets another day in court

A group fighting Measure ULA has another chance to strike down the City of Los Angeles’ real estate transfer tax, after a court agreed to review a case challenging the measure. The U.S. Court of Appeals for the Ninth Circuit will hear arguments over the legality of Measure ULA, which adds a 4 percent tax on commercial and residential sales over $5 million and 5.5 percent tax on sales over $10 million, according to a court notice last week.

Jinky’s Cafe is Returning to Santa Monica

Several months after The Independence, a modern tavern formerly located in the heart of downtown Santa Monica, vacated its space at the intersection of Broadway and 2nd, a Los Angeles coffee shop chain is taking its spot to make a return to the Westside.

Portillo’s Path to Growth Becomes Even Clearer

Presenting at William Blair’s 44th annual Growth Stock Conference, Portillo’s shared two sides of the potential it’s touted since going public in October 2021. Long-term, the Chicago-born brand wants to accelerate to 12–15 percent annual expansion. That would translate to mid-teens sales growth on a low-single-digit comp, and low-teens adjusted EBITDA expansion.

Boot Barn is opening one store a week to cement itself as a national lifestyle brand

Western wear retailer Boot Barn sees stores as the key to building a bigger brand following. A lot of stores. Over the past 12 years, Boot Barn’s footprint has grown from 86 locations in eight states to 400 stores across 45 states. It opened 55 new stores in 2024, more than one per week. Boot Barn sees a path to opening 500 more stores by fiscal year 2030.

Who Would Want To Buy Family Dollar? The Answer Could Be Far-Flung.

With discount chain Family Dollar possibly going up for sale, retail industry analysts and brokers are speculating on who would have the financial wherewithal — or motivation — to acquire a business with nearly 8,000 stores.

Jack in the Box to Open Restaurants in Georgia for the First Time

Jack in the Box announced a significant development agreement to open 15 new Jack in the Box locations throughout Georgia. This expansion marks the company’s entry into the Peach State and signifies continued dynamic growth for the brand in the Southeastern United States.

Long John Silver’s Makes Big Progress on Refreshed Identity

Long John Silver’s president Nate Fowler knows it isn’t a secret he and his team took on a turnaround opportunity when he joined a year and a half ago. As the roughly 500-unit brand approaches its 55th anniversary in August, it continues to explore strategies to elevate an “old-line brand that had some image issues,” the executive says.

Carl’s Jr. and Hardee’s Find Strength in Separation

As leadership began to form under Max Wetzel, who assumed the CEO post of CKE Restaurants in March 2023, migrating over after a four-year run with Papa Johns, it became clear the company had an identity crisis. Only, in this case, Hardee’s and Carl’s Jr. each had the issue of being too distinct.

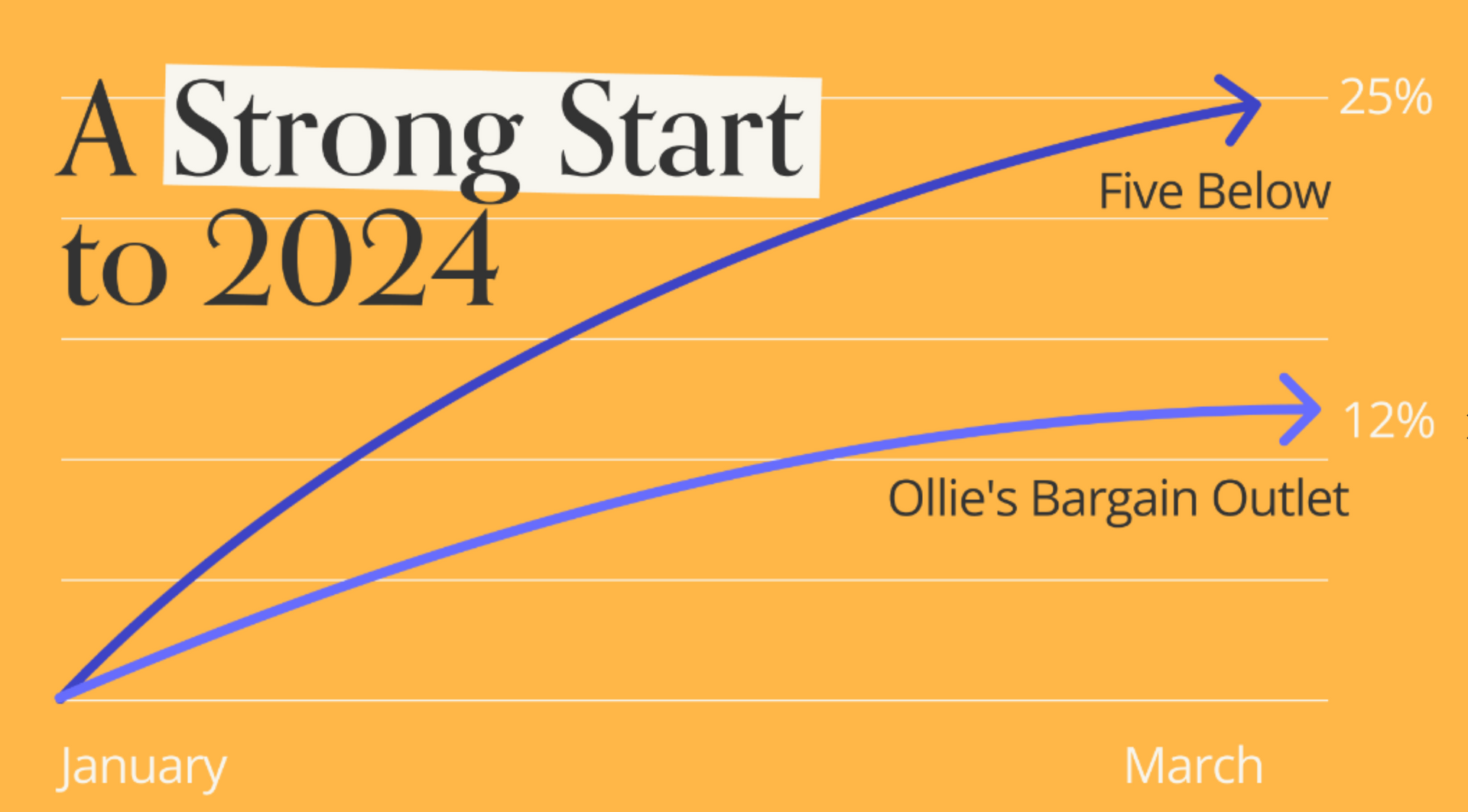

Ollie’s Bargain Outlet and Five Below: Q1 2024 Treasure Troves

We dove into the data to check in with specialty discount chains Ollie’s Bargain Outlet and Five Below. How did they fare in early 2024? And what can the two brands’ recent performance tell us about what lies in store for them in the months ahead?

Rubio’s Closes 48 California Restaurants, Citing Business Costs

Fast-casual restaurant chain Rubio’s Coastal Grill closed 48 California locations, citing rising costs of doing business in the state after a law required higher pay for some workers.

Commercial Real Estate Needs To Follow the "Moneyball" Principle of Adapt or Die

In the popular movie, "Moneyball," the general manager of the Oakland Athletics Major League Baseball team played by Brad Pitt is faced with the challenge of competing against wealthy teams with his gutted roster and a restrictive budget. Given the realities of his situation, the manager is forced to ignore conventional wisdom and fires his head scout, telling him they must "adapt or die."

Big Lots posts 10.2% sales decline in Q1

Shares of discount retailer Big Lots tumbled Thursday after the company reported first-quarter sales declines that were steeper than anticipated. Big Lots previously had forecasted comp-store sales declines in the mid-single digits.