Weekly Perl: A Commercial Real Estate News Recap

US cancels release of CPI report for October because of government shutdown

WASHINGTON, Nov 21 (Reuters) - The U.S. Bureau of Labor Statistics said on Friday it had canceled the release of October's consumer price report because the recently ended government shutdown had prevented the collection of data.

"BLS is unable to retroactively collect these data. For a few indexes, BLS uses nonsurvey data sources instead of survey data to make the index calculations," the BLS said in a statement...

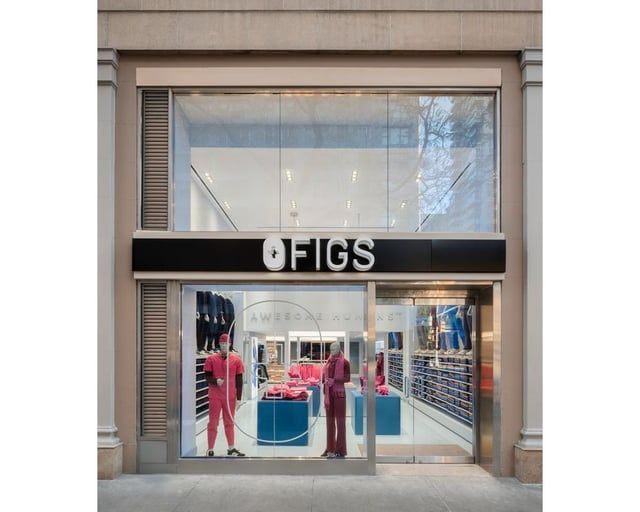

Figs opens new physical location in NYC

A popular healthcare apparel brand has opened its third brick-and-mortar location.

Figs opened its newest store, which the brand calls Community Hubs, in New York City’s Upper East Side on Nov. 15. Figs says the new store is designed to provide shoppers with an immersive experience, including a Color Clinic and a Customization Station. The store features pill chandeliers, seating areas, and “modern-meets-medical” inspired fixtures...

Dick’s turnaround at Foot Locker includes store closures, inventory reset

Dick’s is already testing improvements at 11 Foot Locker stores and named a new head of international for the business.

In its first quarter reporting as a combined business, Dick’s Sporting Goods Executive Chairman Ed Stack said it was time to “clean out the garage” at Foot Locker in an effort that will span stores, inventory and other assets.

For starters, the company is focused on clearing out unproductive inventory across Foot Locker’s business and will close an unspecified number of stores. The company will also rightsize assets “that don’t align with our go-forward vision,” per a release...

T&T Supermarket grows California expansion plans

T&T Supermarket is adding another California location to its 2026 roster.

Canada’s largest Asian grocery chain will open a 52,000-sq.-ft. store in Millbrae at Friendship Plaza in winter 2026. Located in the southern portion of the San Francisco Peninsula, the store will serve several communities in the Bay Area.

Looking ahead to 2026, T&T has several California stores underway including in San Jose, San Francisco, Irvine and Chino Hills. The retailer currently operates two U.S. stores in Bellevue and Lynnwood, Wash. It entered the U.S. market in December 2024...

Gap beats Street as same-store sales surge in Q3

Gap Inc. is crediting a viral campaign for driving revenue at its namesake brand and contributing to its strongest same-store sales in years.

The specialty apparel retailer reported third quarter net income of $236 million, down roughly 14% from $274 million during the same period last year. Diluted earnings fell to $0.62 from $0.72, but beat Wall Street estimates of $0.59. CNBC reports that Gap CFO Katrina O’Connell attributed declining profits to the impact of tariffs, which the retailer previously warned about in its first-quarter fiscal 2025 earnings release...

Belk to open new store concept — here are the locations

Belk Inc. is going smaller.

The 136-year-old regional department store retailer will unveil a new store concept in December in two locations: The Grove at Wesley Chapel in Wesley Chapel, Fla., and The Centre at Preston Ridge in Frisco, Texas. The new Belk Market stores will offer a curated assortment of top national and private label brands in a smaller footprint of 25,000 to 30,000 sq. ft. The company is working on additonal locations to open in 2026...

Abercrombie & Fitch Q3 tops estimates, fueled by strong growth at Hollister

Abercrombie & Fitch Co. reported a better-than-expected third quarter as surging sales for its Hollister brand offset continuing softening sales at its namesake division.

Net income totaled $113 million, or $2.36 per share, for the quarter ended Nov. 2, compared with $131.98 million, or $2.50 per share, a year earlier. Analysts had expected earnings of $2.16 per share...

Bed, Bath & Buy to acquire Brand House Collective; will close 40-plus stores

Bed, Bath & Buy Inc. has entered into a merger deal that will see it acquire The Brand House Collective (formerly Kirkland’s) for $26.8 million in a move to create an “everything home” company.

The deal, which has been unanimously approved by boards of both companies, is expected to close in the first quarter of 2026 pending shareholder approval and the consent of lender Bank of America. The two companies have been working together since September 2024, when Kirkland’s entered into a deal that would result in the return of Bed Bath & Beyond brick-and-mortar stores to the U.S. retail landscape...

As holiday shopping gets underway, here are 10 features that make malls successful

This year's holiday season is expected to be a shopping record breaker.

For the first time ever, spending is projected to surpass $1 trillion, according to the National Retail Federation. And 186.9 million people are planning to shop during the upcoming Black Friday weekend, another high point.

Malls that have kept up with the times are likely to attract healthy foot traffic and revenue for the holidays, just as they do during other times of the year, according to retail analysts...