Weekly Retail Real Estate News

Burger King, After $1B Deal, Emphasizes New Franchising Philosophy

Over nearly 50 years, Carrols Restaurant Group became Burger King’s biggest franchisee at more than 1,000 locations nationwide. It operates about 15 percent of the chain’s U.S. footprint. Don’t expect that to happen again, at least not in the foreseeable future. On Tuesday, Burger King announced plans to acquire Carrols for $1 billion, with two key purposes in mind—use $500 million to accelerate the pace of 600 remodels, and refranchise stores over the next five years.

Proposed Kroger, Albertsons merger delayed

The proposed merger between two U.S. supermarket giants is no longer expected to be completed in March.The Kroger Co.’s proposed $24.6 billion acquisition of rival Albertsons is now expected to close in the first half of Kroger’s fiscal year 2024 instead of early this year, according to a joint statement made by The Kroger Co., Albertsons Cos. Inc. and C&S Wholesale Grocers LLC.

Freddy's aims for 800 restaurants by 2026

Freddy’s Frozen Custard & Steakburgers is not pulling back from its rapid expansion. The fast-casual chain known for burgers and ice cream opened a company-record 62 new restaurants across the United States last year, including its 500th location.

Google: Retailers see promise for generative AI

Most retail decision-makers think generative will have a big impact on their industry. That's one of the findings of a study commissioned by Google Cloud of 274 U.S. C-suite executives, information technology leads, and business development managers. The majority (81%) of respondents feel urgency to adopt generative AI technologies, with 72% ready to deploy generative AI in the coming year.

7-Eleven to acquire 204 Stripes stores in $1 billion deal

7-Eleven, Inc. is expanding its footprint. The convenience store giant has entered into an agreement to acquire 204 stores from Sunoco LP, which includes Stripes convenience stores and Laredo Taco Company restaurants. The deal is valued at approximately $1 billion.

Santa Monica Seeks Developer for Civic Revitalization

The city of Santa Monica is searching for a person or entity up to the task of turning the Civic Auditorium back into a hotspot for entertainment, arts and culture. Once selected, the party would renovate, reopen, program and manage the property while leasing the site. According to a post from the city, ideal candidates have a track record of renovating historic sites, programming cultural art events, financial solvency for development and are open to community input.

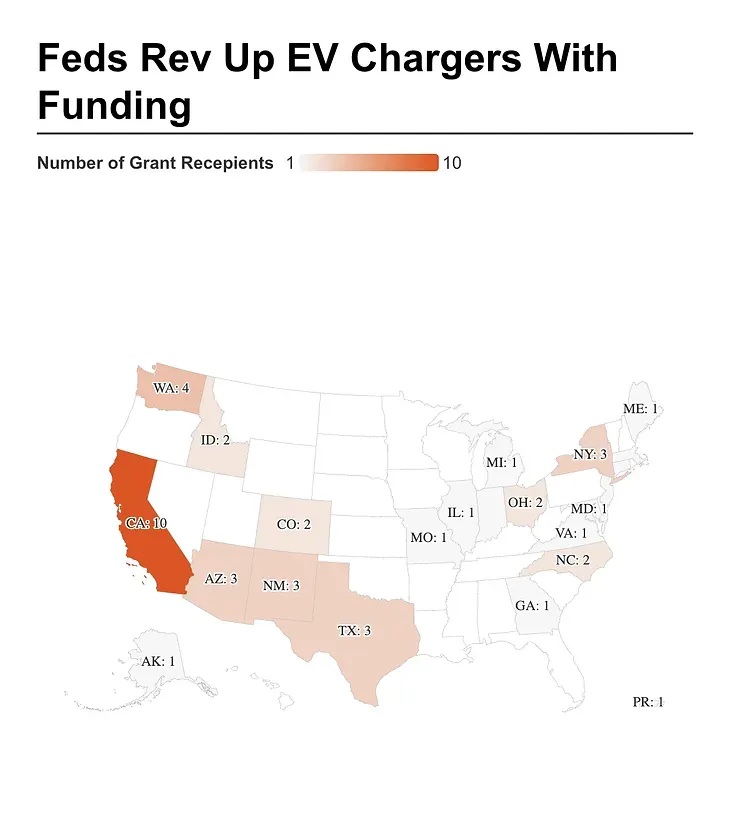

Feds Award $623 Million in Grants To Deploy Electric Vehicle Charging Stations

About $623 million in federal grants were awarded to 22 states and Puerto Rico to install electric vehicle charging stations as part of the Biden administration’s push to shift the United States away from gas-powered vehicles.Cities, states and tribal groups nationwide were named recipients Thursday for funding to install chargers along heavily traveled highways and in underserved areas.

H-E-B, Amazon top Dunnhumby's latest preference index

For the third time, a Texas regional grocery powerhouse has ranked as the top U.S. grocery retailer. H-E-B took the top spot in the seventh annual Dunnhumby Retailer Preference Index (RPI), a nationwide study of the approximately $1 trillion U.S. grocery market. The San Antonio-based chain, which operates 430 stores in Texas and Mexico, is the first grocery retailer to be recognized three times as number one in the RPI ranking.