The Hidden Risks of Showing Your Off-Market Property to Buyers – Revealed!

Why Off-Market Listings Could Be Your Worst Move as a Property Owner

Hello, wise retail real estate owners! You have a property that you are thinking about selling, but it isn't currently on the market. "What's the harm in showing it to a potential buyer?" you could ask. Keep it in mind. Let's examine the reasons why this could be a mistake.

Loss of Leverage

Even when you're not formally "on the market," you are still in control. When you take a buyer to see your property, you are expressing your desire to sell. You may be at a disadvantage in negotiations as a result. Would you reveal your poker hand to someone? Did not believe so.

Distorted Pricing

If a buyer is aware they are the first to view or know about your intentions to sell the retail property, they can offer you a cheap price in the belief they can haggle. This may establish a low bar for the property's worth, making it difficult to obtain the amount you are truly entitled to. It's like placing a low initial offer at an auction; this is risky ground!

Time and Effort Drain

Every performance requires time and work. If the buyer isn't serious or thoroughly vetted, you're effectively wasting your time. These hours may be better used for market research, spending time with family, or even a game of golf.

Legal Snags

You can run the risk of legal trouble if you exhibit an off-market property in particular circumstances. Contracts and rules are in place for a purpose; deviating from them might lead to a host of problems you'd want to avoid.

Don't take a chance with your money. If you're thinking about selling your retail property, engage with experts who are familiar with the market. Let us assist you in maximizing returns while reducing risks. To get in touch with professionals who can help you navigate a successful, profitable sale, Call us today.

#RetailRealEstate #OffMarketRisks #MarcRetailGuy #PropertyOwnership #SmartSelling #MaximizeReturns

📣 Retail Property Owners, Listen Up! 📣

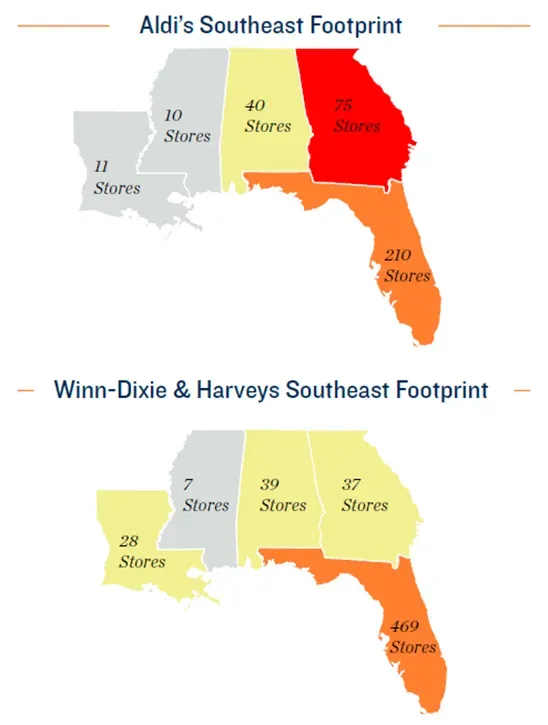

Don't just stand there like a deer in headlights. Take action! Evaluate your properties, consider potential new tenants, and maybe even give your property a little facelift. The ALDI wave could lift all boats, so make sure yours is ready to sail! Contact us now for personalized advice.

#RetailRealEstate #ALDIExpansion #MarcRetailGuy #PropertyValueBoost #GameChangerDeal #InvestSmart