Unlocking Profit: Jack in the Box's Expansion Secret!

Hey, Retail Real Estate Rockstars!

Let's break down some big news from Jack in the Box's 1Q2024 earnings call that took place on Wednesday, February 21, 2024, and why it's super important for retail real estate owners:

- A little dip in the money bag: Even though they brought in a bit less cash this time, down 7.5% to $487.5 million from last year, it's mostly because they're changing up how they run Del Taco stores. But hey, they're still pushing forward with cool new stuff.¹

- They really knocked it out of the park with their earnings, doing better than what analysts thought they would. Plus, they're expanding to new places like Florida and Michigan.²

- They've got this new burger, the Smashed Jack, that's got everyone talking and wanting more. ²

- They're getting really into online orders, aiming for 20% of their sales to come from clicks and taps. ²

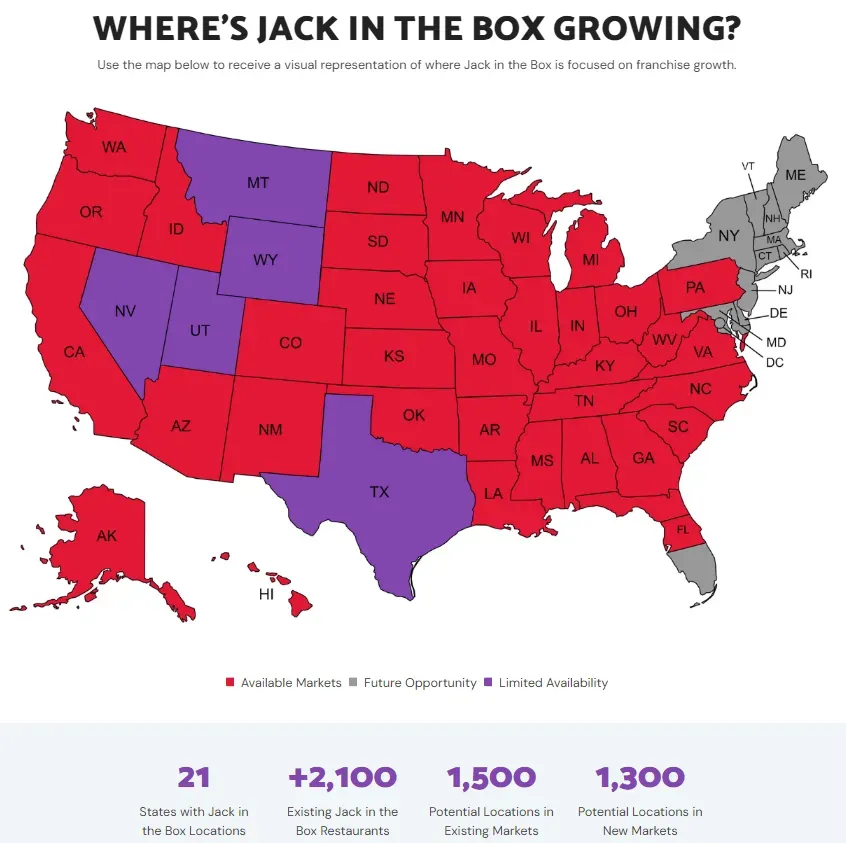

- With plans to open more stores, having signed agreements for 91 new openings, they're not slowing down. ²

For those owning retail property, Jack in the Box's moves are a big deal. Their growth could mean more value for your spaces.

Curious about how this could benefit your property? Call, Text, or DM me for more info.

Thinking about all this, how are you gearing up your retail space to attract big names like Jack in the Box?

#RetailRealEstate #JackInTheBox #MarcRetailGuy #GrowthOpportunities #PropertyInvestment

Sources:

2. https://www.youtube.com/watch?v=8KGzeJtGFEs

3. https://www.jackintheboxfranchising.com/available-markets